Currency strength is the relative purchasing power of a national currency when traded for products or against other currencies. A currency’s strength is determined by the interaction of a variety of local and international factors such as the demand and supply in the foreign exchange markets.

The U.S. Dollar is currently considered as the strongest currency in the world. The U.S. economy has the largest consumer market, and the USD serves as the primary trade and reserve currency all around the globe.

Currency strength in the domestic economy refers to its purchasing power over locally produced goods and services. In the foreign exchange markets, a currency’s strength is measured in relation to foreign currencies in the Forex currency pairs.

The strength of a national currency can affect the country’s domestic economy and international trade activities in various ways. When the economy is stagnant, the central bank can cut the interest rates to reduce currency strength. Decreasing borrowing costs accelerates production, and the national Gross Domestic Product (GDP) grows.

Enhanced income and wages of the citizens translate into increased spending.

Purchasing Power Parity (PPP) is an important macroeconomic metric used to measure currency strength. PPP is a theory that compares the cost of a ‘basket of goods’ in different countries using their respective local currencies.

For economists, PPP helps in comparing standards of living as well as economic productivity of different countries.

PPP is also very important in international trade as it helps in determining the best places to shop for the best prices of various products. The overall concept of PPP is based on the law of ‘one price’. Currency strength is the main determinant of the price rates of the Forex currency pairs in the financial markets.

Currency strength for trading

As most short-term traders prefer news trading strategies, the economic events that influence a currency’s value can create significant market turmoil. Whether your favourite currencies rise or fall against others, you can use CFD trading to open Long or Short positions. A high exchange rate does not necessarily indicate a strong currency. The relative strength of a currency is seen over a long period of time. Changes are determined by supply and demand, as well as inflation and interest rates.

We highly recommend that you take advantage of it which you can do for free as often as you like simply by streaming the data from our website. Remember, if you can pair the correct currencies together, you can create the maximum profit potential.

Currency strength indicator

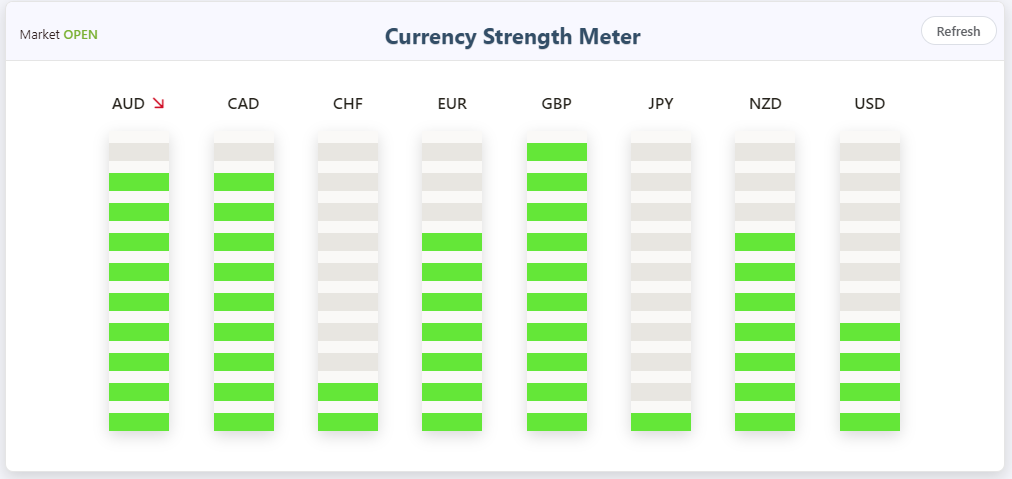

The currency strength meter is the secret weapon of successful trading. The value of any given currency pair will constantly change over the course of any given trading period. Using currency strength meters, currency strength indicators, and other useful trading tools can help forex traders improve their strategies and remain ahead of the global market.

The currency strength meter is a tool to help you determine the best pair to trade on any given day. Not all currency strength indicators are created equal.

If the currency strength formula is wrong, the whole strength readings will be misleading.

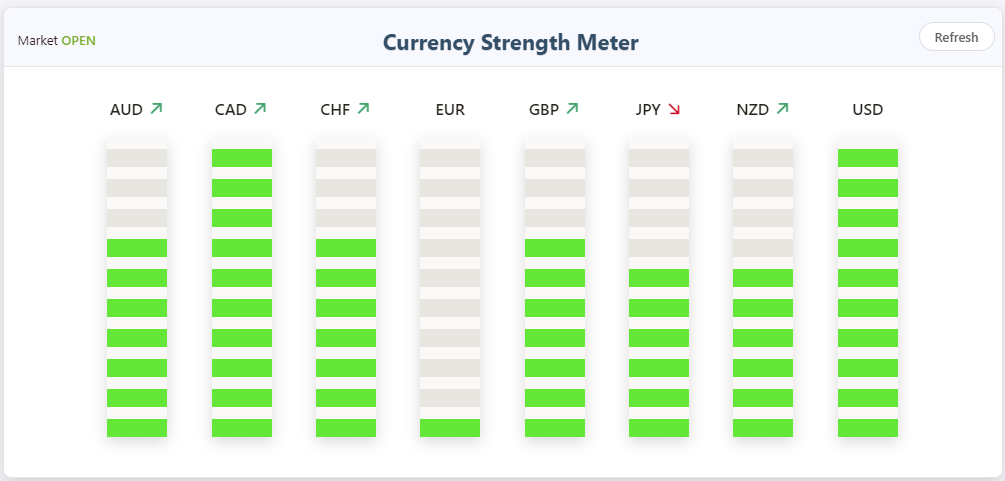

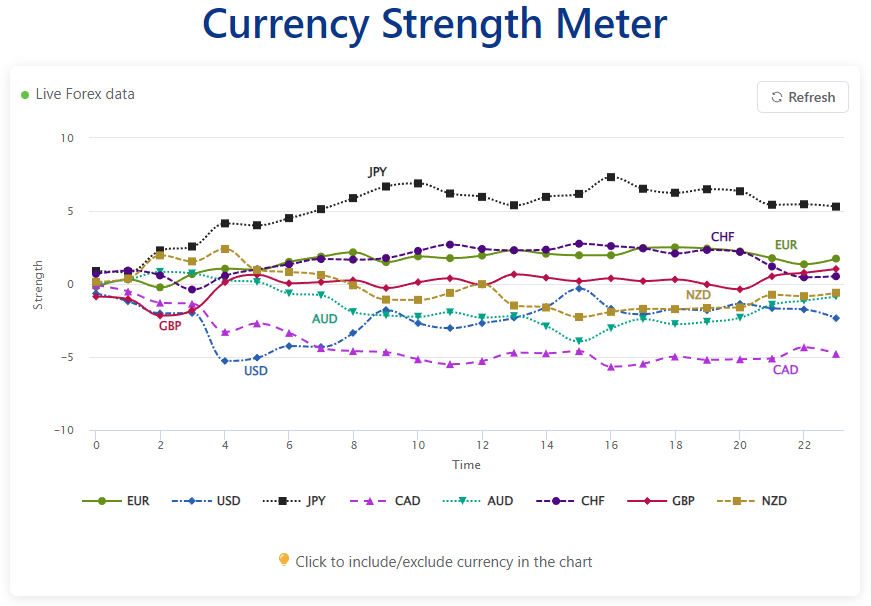

We use a proprietary trading formula that aggregates prices from multiple time frames and apply our own weightings to produce the most effective currency strength indicator.

Our proprietary formula to calculate the currency strength works better than all other free currency strength indicators combined.

We offer a comprehensive approach to determining the value of the underlying currency. Our currency heat map can help you gauge when a currency is losing its strength and a reversal is coming.

For example, the strongest currency pair right now is JPY, and EUR is JPY.

The biggest potential deal is to sell EUR/JPY. This is nothing more than a form of trading in the direction of the trend.

It will give us a more detailed view of the strength of the currency on multiple time frames. As a result, we pair the two currencies and end up with NZD/CHF, which has a potential buying opportunity. After a few hours of trading activity, here is the outcome of that trade: The strongest currency continued to strengthen and the weakest currency continued to weaken.

How do you measure the strength of a currency?

Currency strength meter is a clear indicator of whether corresponding currency pairs are about to experience a change in value. Understanding currency strength will be key for developing a long-term forex trading strategy.

The currency strength index, the currency strength meter(), and other currency strength indicators will directly affect your ability to determine whether a relative value change is likely to occur.

Figure 2 is a striking illustration of how global trade activity fluctuates with the strength of the dollar. Trade activity is strong when the dollar is weak, but global trade suffers when the dollar is strong. One candidate explanation is that credit conditions for exporters’ working capital dance to the tune of dollar strength, so that trade fluctuations are shaped by financial conditions.

The dollar exchange rate serves as a barometer for credit conditions. Financial conditions also have real economy consequences through their influence on real variables. Among indicators of financial conditions, the US dollar exchange rate plays a particularly important role as a barometer of dollar credit conditions.

Dollar credit grows faster when the dollar is weak and grows more slowly or declines when the dollar is strong. Using finely disaggregated data on export shipments from Mexico, we trace the impact of dollar strength on the shipments of exporters who have financing needs for working capital.

달러 신용은 달러가 약할 때 더 빨리 성장하고 달러가 강할 때 더 천천히 성장하거나 하락합니다. 멕시코로부터의 수출 선적에 대한 미세하게 분해 된 데이터를 사용하여, 우리는 작업 자본에 대한 자금 조달이 필요한 수출업자의 선적에 대한 달러 강도의 영향을 추적합니다.

Thanks, which indicators do you describe in the article?