bureau와 bureau_bal 데이터 세트 기반의 EDA와 Feature Engineering 수행 후 학습 모델 생성/평가

라이브러리 및 데이터 세트 로딩.

import numpy as np

import pandas as pd

import gc

import time

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

pd.set_option('display.max_rows', 100)

pd.set_option('display.max_columns', 200)def get_dataset():

app_train = pd.read_csv('application_train.csv')

app_test = pd.read_csv('application_test.csv')

apps = pd.concat([app_train, app_test])

prev = pd.read_csv('previous_application.csv')

bureau = pd.read_csv('bureau.csv')

bureau_bal = pd.read_csv('bureau_balance.csv')

return apps, prev, bureau, bureau_bal

apps, prev, bureau, bureau_bal = get_dataset()<ipython-input-2-eb2bde2565da>:4: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

apps = pd.concat([app_train, app_test])bureau와 bureau_balance 컬럼 설명

| Table | 컬럼명 | 컬럼 대분류 | 컬럼 중분류 | 컬럼 설명 |

|---|---|---|---|---|

| bureau.csv | SK_ID_CURR | 대출 | 고유ID | 현재 대출 고유 ID |

| bureau.csv | SK_BUREAU_ID | 대출 | 고유ID | 타 기관 대출 고유 ID |

| bureau.csv | CREDIT_ACTIVE | 대출 | 대출 상태 | 대출 상태(Active: 대출 상환중, Closed: 상환 완료) |

| bureau.csv | CREDIT_CURRENCY | 대출 | 대출 금액 | 대출 금액 화폐유형 |

| bureau.csv | DAYS_CREDIT | 대출 | 행동 | 현재 대출 신청 일 기준 과거 대출 신청 지난 기간 |

| bureau.csv | CREDIT_DAY_OVERDUE | 대출 | 행동 | 대출 신청 시 CB 크레딧 연체 일수 |

| bureau.csv | DAYS_CREDIT_ENDDATE | 대출 | 상태 | CB 크레딧 채무 완료까지 남아있는 일수(신청일 기준) |

| bureau.csv | DAYS_ENDDATE_FACT | 대출 | 상태 | CB 크레딧 채무 완료까지 걸린 실제 일수(신청일 기준, 상태가 Close일때만) |

| bureau.csv | AMT_CREDIT_MAX_OVERDUE | 대출 | 상태 | 최대 연체금액 |

| bureau.csv | CNT_CREDIT_PROLONG | 대출 | 상태 | 신용 연장 횟수 |

| bureau.csv | AMT_CREDIT_SUM | 대출 | 대출 금액 | 현재 크레딧 금액 총액 |

| bureau.csv | AMT_CREDIT_SUM_DEBT | 대출 | 대출 금액 | 현재 채무 금액 총액 |

| bureau.csv | AMT_CREDIT_SUM_LIMIT | 대출 | 대출 금액 | 신용 카드 현재 신용한도 |

| bureau.csv | AMT_CREDIT_SUM_OVERDUE | 대출 | 상태 | 현재 연체 금액 |

| bureau.csv | CREDIT_TYPE | 대출 | 대출 유형 | 크레딧 유형 |

| bureau.csv | DAYS_CREDIT_UPDATE | 대출 | 대출 행동 | 대출 신청전 마지막 정보 받은 기간 |

| bureau.csv | AMT_ANNUITY | 대출 | 대출 금액 | 월 대출 지급액 |

| bureau_balance.csv | SK_BUREAU_ID | 대출 | 고유ID | 타 기관 대출 고유 ID |

| bureau_balance.csv | MONTHS_BALANCE | 대출 | 상태 | 신청일 기준 잔액 월 |

| bureau_balance.csv | STATUS | 대출 | 상태 | 월별 대출 상태(Active: 대출 상환중, Closed: 상환 완료, DPD0-30: 30일 이전 연체 상태등 |

bureau.head(20)| SK_ID_CURR | SK_ID_BUREAU | CREDIT_ACTIVE | CREDIT_CURRENCY | DAYS_CREDIT | CREDIT_DAY_OVERDUE | DAYS_CREDIT_ENDDATE | DAYS_ENDDATE_FACT | AMT_CREDIT_MAX_OVERDUE | CNT_CREDIT_PROLONG | AMT_CREDIT_SUM | AMT_CREDIT_SUM_DEBT | AMT_CREDIT_SUM_LIMIT | AMT_CREDIT_SUM_OVERDUE | CREDIT_TYPE | DAYS_CREDIT_UPDATE | AMT_ANNUITY | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 215354 | 5714462 | Closed | currency 1 | -497 | 0 | -153.0 | -153.0 | NaN | 0 | 91323.00 | 0.00 | NaN | 0.0 | Consumer credit | -131 | NaN |

| 1 | 215354 | 5714463 | Active | currency 1 | -208 | 0 | 1075.0 | NaN | NaN | 0 | 225000.00 | 171342.00 | NaN | 0.0 | Credit card | -20 | NaN |

| 2 | 215354 | 5714464 | Active | currency 1 | -203 | 0 | 528.0 | NaN | NaN | 0 | 464323.50 | NaN | NaN | 0.0 | Consumer credit | -16 | NaN |

| 3 | 215354 | 5714465 | Active | currency 1 | -203 | 0 | NaN | NaN | NaN | 0 | 90000.00 | NaN | NaN | 0.0 | Credit card | -16 | NaN |

| 4 | 215354 | 5714466 | Active | currency 1 | -629 | 0 | 1197.0 | NaN | 77674.5 | 0 | 2700000.00 | NaN | NaN | 0.0 | Consumer credit | -21 | NaN |

| 5 | 215354 | 5714467 | Active | currency 1 | -273 | 0 | 27460.0 | NaN | 0.0 | 0 | 180000.00 | 71017.38 | 108982.62 | 0.0 | Credit card | -31 | NaN |

| 6 | 215354 | 5714468 | Active | currency 1 | -43 | 0 | 79.0 | NaN | 0.0 | 0 | 42103.80 | 42103.80 | 0.00 | 0.0 | Consumer credit | -22 | NaN |

| 7 | 162297 | 5714469 | Closed | currency 1 | -1896 | 0 | -1684.0 | -1710.0 | 14985.0 | 0 | 76878.45 | 0.00 | 0.00 | 0.0 | Consumer credit | -1710 | NaN |

| 8 | 162297 | 5714470 | Closed | currency 1 | -1146 | 0 | -811.0 | -840.0 | 0.0 | 0 | 103007.70 | 0.00 | 0.00 | 0.0 | Consumer credit | -840 | NaN |

| 9 | 162297 | 5714471 | Active | currency 1 | -1146 | 0 | -484.0 | NaN | 0.0 | 0 | 4500.00 | 0.00 | 0.00 | 0.0 | Credit card | -690 | NaN |

| 10 | 162297 | 5714472 | Active | currency 1 | -1146 | 0 | -180.0 | NaN | 0.0 | 0 | 337500.00 | 0.00 | 0.00 | 0.0 | Credit card | -690 | NaN |

| 11 | 162297 | 5714473 | Closed | currency 1 | -2456 | 0 | -629.0 | -825.0 | NaN | 0 | 675000.00 | 0.00 | 0.00 | 0.0 | Consumer credit | -706 | NaN |

| 12 | 162297 | 5714474 | Active | currency 1 | -277 | 0 | 5261.0 | NaN | 0.0 | 0 | 7033500.00 | NaN | NaN | 0.0 | Mortgage | -31 | NaN |

| 13 | 402440 | 5714475 | Active | currency 1 | -96 | 0 | 269.0 | NaN | 0.0 | 0 | 89910.00 | 76905.00 | 0.00 | 0.0 | Consumer credit | -22 | NaN |

| 14 | 238881 | 5714482 | Closed | currency 1 | -318 | 0 | -187.0 | -187.0 | NaN | 0 | 0.00 | 0.00 | 0.00 | 0.0 | Credit card | -185 | NaN |

| 15 | 238881 | 5714484 | Closed | currency 1 | -2911 | 0 | -2607.0 | -2604.0 | NaN | 0 | 48555.00 | NaN | NaN | 0.0 | Consumer credit | -2601 | NaN |

| 16 | 238881 | 5714485 | Closed | currency 1 | -2148 | 0 | -1595.0 | -987.0 | NaN | 0 | 135000.00 | NaN | NaN | 0.0 | Consumer credit | -984 | NaN |

| 17 | 238881 | 5714486 | Active | currency 1 | -381 | 0 | NaN | NaN | NaN | 0 | 450000.00 | 520920.00 | NaN | 0.0 | Consumer credit | -4 | NaN |

| 18 | 238881 | 5714487 | Active | currency 1 | -95 | 0 | 1720.0 | NaN | NaN | 0 | 67500.00 | 8131.50 | NaN | 0.0 | Credit card | -7 | NaN |

| 19 | 238881 | 5714488 | Closed | currency 1 | -444 | 0 | -77.0 | -77.0 | 0.0 | 0 | 107184.06 | 0.00 | 0.00 | 0.0 | Consumer credit | -71 | NaN |

bureau, bureau_bal 컬럼 및 Null 조사

bureau.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1716428 entries, 0 to 1716427

Data columns (total 17 columns):

SK_ID_CURR int64

SK_ID_BUREAU int64

CREDIT_ACTIVE object

CREDIT_CURRENCY object

DAYS_CREDIT int64

CREDIT_DAY_OVERDUE int64

DAYS_CREDIT_ENDDATE float64

DAYS_ENDDATE_FACT float64

AMT_CREDIT_MAX_OVERDUE float64

CNT_CREDIT_PROLONG int64

AMT_CREDIT_SUM float64

AMT_CREDIT_SUM_DEBT float64

AMT_CREDIT_SUM_LIMIT float64

AMT_CREDIT_SUM_OVERDUE float64

CREDIT_TYPE object

DAYS_CREDIT_UPDATE int64

AMT_ANNUITY float64

dtypes: float64(8), int64(6), object(3)

memory usage: 222.6+ MB# DAYS_ENDDATE_FACT, AMT_CREDIT_MAX_OVERDUE, AMT_CREDIT_SUM_LIMT, AMT_ANNUITY 등이 Null 컬럼이 많음.

bureau.isnull().sum()SK_ID_CURR 0

SK_ID_BUREAU 0

CREDIT_ACTIVE 0

CREDIT_CURRENCY 0

DAYS_CREDIT 0

CREDIT_DAY_OVERDUE 0

DAYS_CREDIT_ENDDATE 105553

DAYS_ENDDATE_FACT 633653

AMT_CREDIT_MAX_OVERDUE 1124488

CNT_CREDIT_PROLONG 0

AMT_CREDIT_SUM 13

AMT_CREDIT_SUM_DEBT 257669

AMT_CREDIT_SUM_LIMIT 591780

AMT_CREDIT_SUM_OVERDUE 0

CREDIT_TYPE 0

DAYS_CREDIT_UPDATE 0

AMT_ANNUITY 1226791

dtype: int64bureau_bal.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 27299925 entries, 0 to 27299924

Data columns (total 3 columns):

SK_ID_BUREAU int64

MONTHS_BALANCE int64

STATUS object

dtypes: int64(2), object(1)

memory usage: 624.8+ MBbureau_bal.head(30)| SK_ID_BUREAU | MONTHS_BALANCE | STATUS | |

|---|---|---|---|

| 0 | 5715448 | 0 | C |

| 1 | 5715448 | -1 | C |

| 2 | 5715448 | -2 | C |

| 3 | 5715448 | -3 | C |

| 4 | 5715448 | -4 | C |

| 5 | 5715448 | -5 | C |

| 6 | 5715448 | -6 | C |

| 7 | 5715448 | -7 | C |

| 8 | 5715448 | -8 | C |

| 9 | 5715448 | -9 | 0 |

| 10 | 5715448 | -10 | 0 |

| 11 | 5715448 | -11 | X |

| 12 | 5715448 | -12 | X |

| 13 | 5715448 | -13 | X |

| 14 | 5715448 | -14 | 0 |

| 15 | 5715448 | -15 | 0 |

| 16 | 5715448 | -16 | 0 |

| 17 | 5715448 | -17 | 0 |

| 18 | 5715448 | -18 | 0 |

| 19 | 5715448 | -19 | 0 |

| 20 | 5715448 | -20 | X |

| 21 | 5715448 | -21 | X |

| 22 | 5715448 | -22 | X |

| 23 | 5715448 | -23 | X |

| 24 | 5715448 | -24 | X |

| 25 | 5715448 | -25 | X |

| 26 | 5715448 | -26 | X |

| 27 | 5715449 | 0 | C |

| 28 | 5715449 | -1 | C |

| 29 | 5715449 | -2 | C |

bureau[bureau['SK_ID_BUREAU'] == 5715448].head()| SK_ID_CURR | SK_ID_BUREAU | CREDIT_ACTIVE | CREDIT_CURRENCY | DAYS_CREDIT | CREDIT_DAY_OVERDUE | DAYS_CREDIT_ENDDATE | DAYS_ENDDATE_FACT | AMT_CREDIT_MAX_OVERDUE | CNT_CREDIT_PROLONG | AMT_CREDIT_SUM | AMT_CREDIT_SUM_DEBT | AMT_CREDIT_SUM_LIMIT | AMT_CREDIT_SUM_OVERDUE | CREDIT_TYPE | DAYS_CREDIT_UPDATE | AMT_ANNUITY | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 768 | 380361 | 5715448 | Active | currency 1 | -820 | 0 | 31069.0 | NaN | NaN | 0 | 67500.0 | 0.0 | 67500.0 | 0.0 | Credit card | -183 | 0.0 |

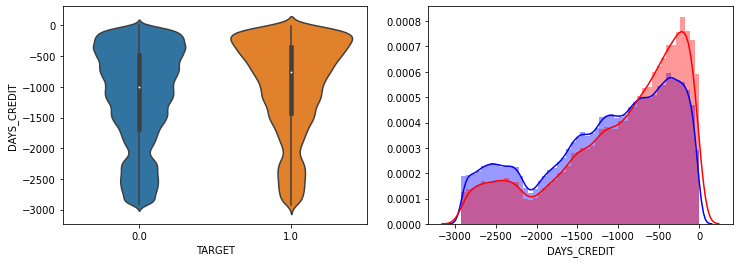

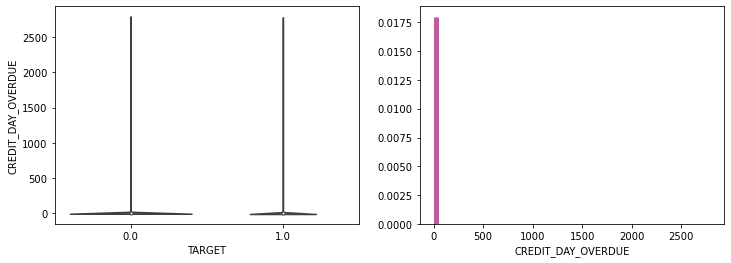

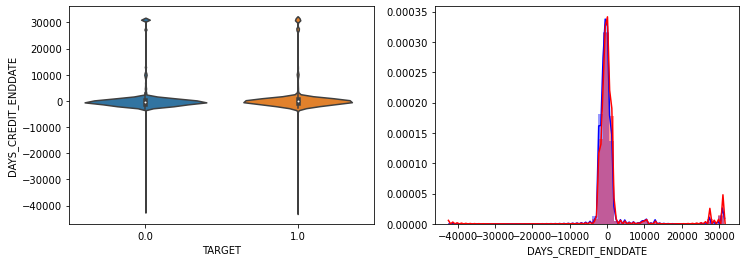

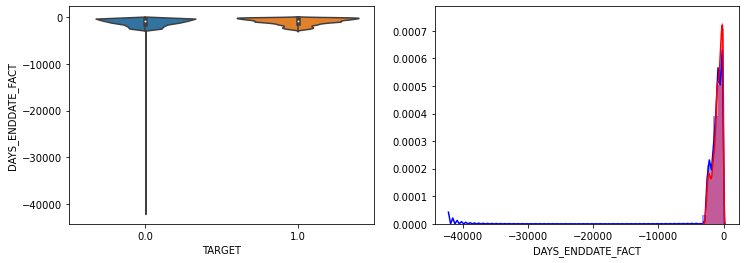

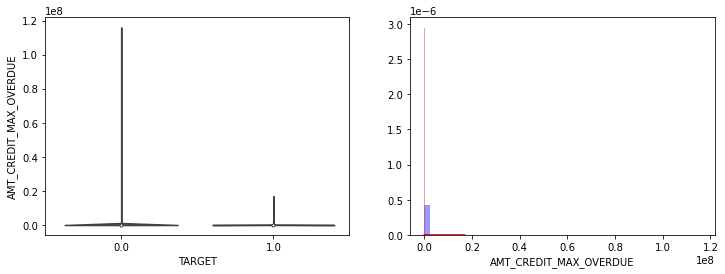

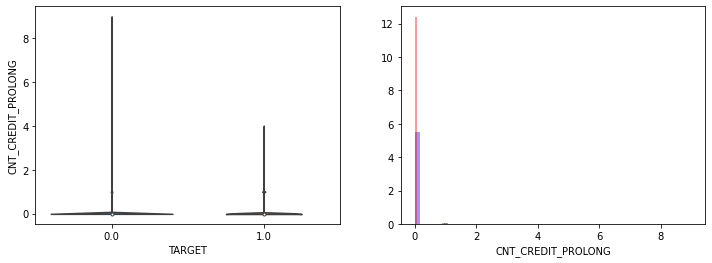

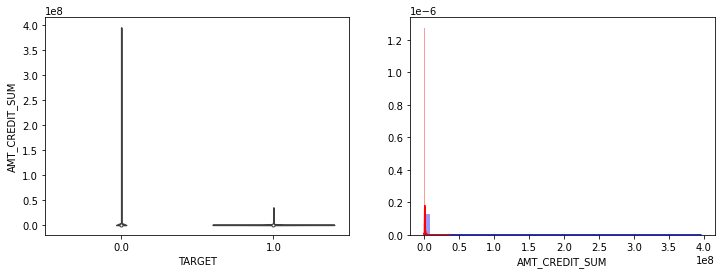

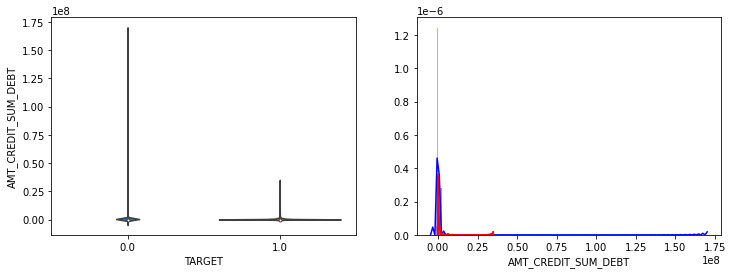

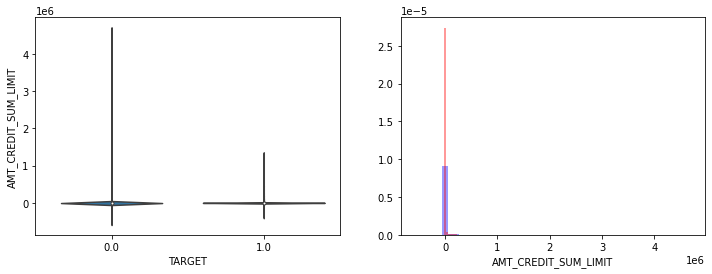

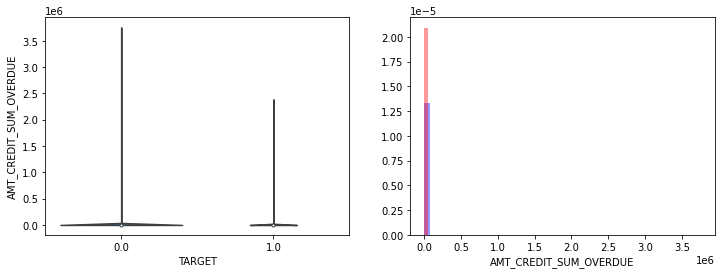

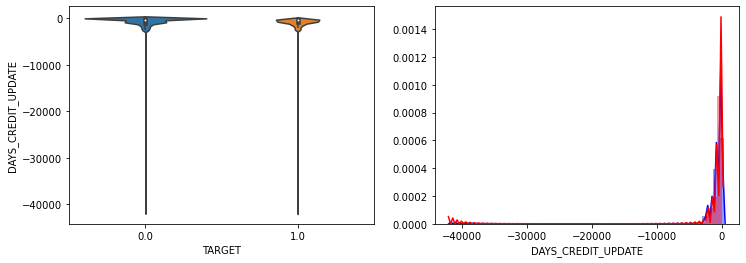

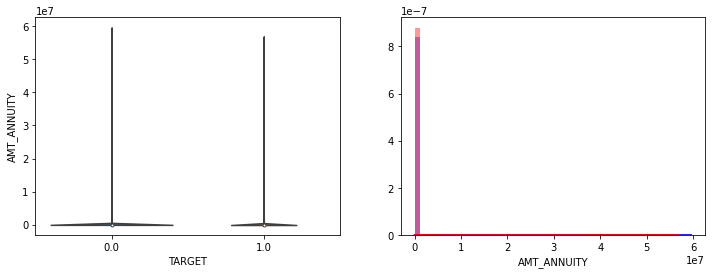

숫자형 피처들의 Histogram을 TARGET 유형에 따라 비교

# TARGET 값을 가져오기 위해 bureau를 apps와 조인

bureau_app = bureau.merge(apps[['SK_ID_CURR', 'TARGET']], on='SK_ID_CURR', how='left')num_columns = bureau_app.dtypes[bureau_app.dtypes != 'object'].index.tolist()

# 숫자형 컬럼중 ID와 TARGET은 제외

num_columns = [column for column in num_columns if column not in['SK_ID_BUREAU', 'SK_ID_CURR', 'TARGET']]

print(num_columns)

def show_hist_by_target(df, columns):

cond_1 = (df['TARGET'] == 1)

cond_0 = (df['TARGET'] == 0)

for column in columns:

print("column:", column)

fig, axs = plt.subplots(nrows=1, ncols=2, figsize=(12, 4), squeeze=False)

# bureau는 특정 컬럼값이 infinite로 들어가있는 경우가 있음. infinite일 경우 KDE histogram 시각화 시 문제 발생하여 이를 제거

sns.violinplot(x='TARGET', y=column, data=df[np.isfinite(df[column])], ax=axs[0][0])

sns.distplot(df[cond_0 & np.isfinite(df[column])][column], label='0', color='blue', ax=axs[0][1])

sns.distplot(df[cond_1 & np.isfinite(df[column])][column], label='1', color='red', ax=axs[0][1])

show_hist_by_target(bureau_app, num_columns)

['DAYS_CREDIT', 'CREDIT_DAY_OVERDUE', 'DAYS_CREDIT_ENDDATE', 'DAYS_ENDDATE_FACT', 'AMT_CREDIT_MAX_OVERDUE', 'CNT_CREDIT_PROLONG', 'AMT_CREDIT_SUM', 'AMT_CREDIT_SUM_DEBT', 'AMT_CREDIT_SUM_LIMIT', 'AMT_CREDIT_SUM_OVERDUE', 'DAYS_CREDIT_UPDATE', 'AMT_ANNUITY']

column: DAYS_CREDIT

column: CREDIT_DAY_OVERDUE

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

column: DAYS_CREDIT_ENDDATE

column: DAYS_ENDDATE_FACT

column: AMT_CREDIT_MAX_OVERDUE

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

column: CNT_CREDIT_PROLONG

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

column: AMT_CREDIT_SUM

column: AMT_CREDIT_SUM_DEBT

column: AMT_CREDIT_SUM_LIMIT

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

column: AMT_CREDIT_SUM_OVERDUE

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

column: DAYS_CREDIT_UPDATE

column: AMT_ANNUITY

np.isfinite(bureau_app['AMT_CREDIT_SUM_LIMIT']).sum()1124648- DAYS_CREDIT는 TARGET=1 일때 상대적으로 최근에 더 빈번하게 대출.

- 나머지 컬럼들은 의미있는 차이를 찾기 어려움

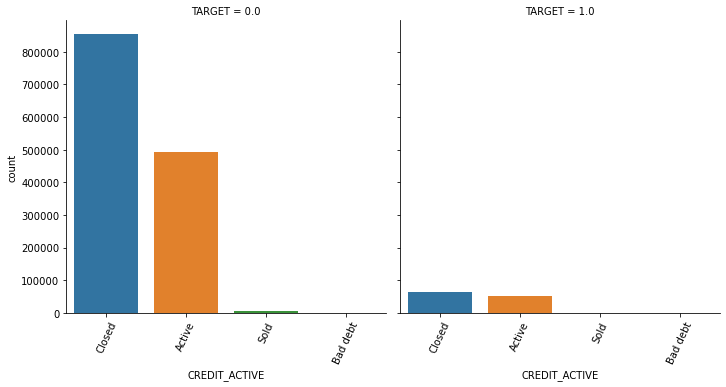

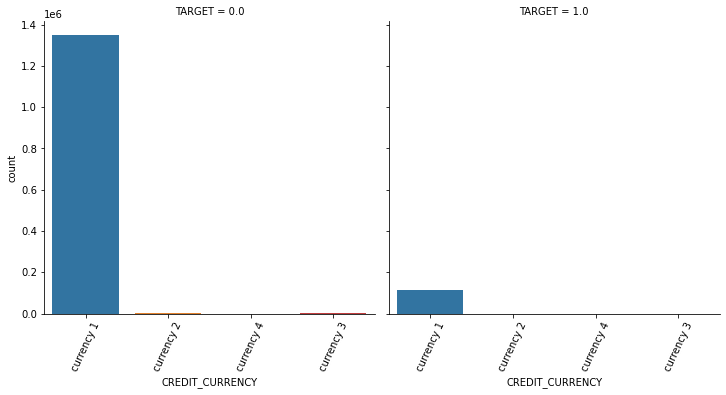

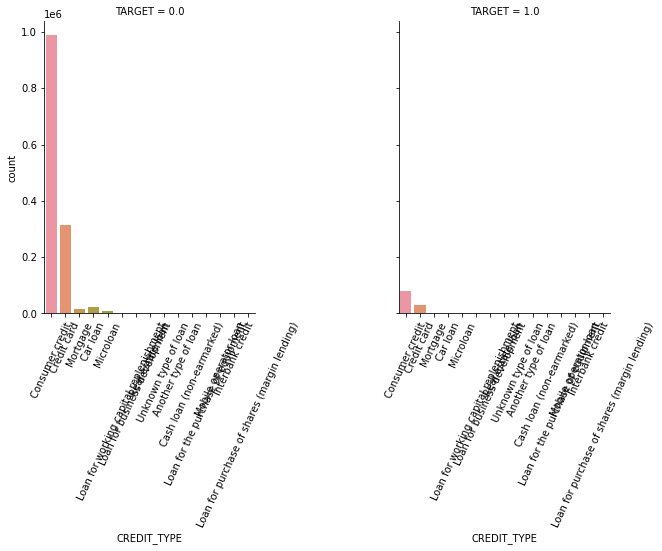

Category 피처들의 Histogram을 TARGET 유형에 따라 비교

object_columns = bureau.dtypes[bureau.dtypes=='object'].index.tolist()

print(object_columns)

def show_category_by_target(df, columns):

for column in columns:

chart = sns.catplot(x=column, col="TARGET", data=df, kind="count")

chart.set_xticklabels(rotation=65)

show_category_by_target(bureau_app, object_columns)['CREDIT_ACTIVE', 'CREDIT_CURRENCY', 'CREDIT_TYPE']

- 현재 상태가 Active인 건이 TARGET이 1일때 비율이 높아짐.

bureau 채무 완료 날짜 및 대출 금액 대비 채무 금액 관련 컬럼 가공.

# 예정 채무 시작 및 완료일과 실제 채무 완료일간의 차이 및 날짜 비율 가공.

bureau['BUREAU_ENDDATE_FACT_DIFF'] = bureau['DAYS_CREDIT_ENDDATE'] - bureau['DAYS_ENDDATE_FACT']

bureau['BUREAU_CREDIT_FACT_DIFF'] = bureau['DAYS_CREDIT'] - bureau['DAYS_ENDDATE_FACT']

bureau['BUREAU_CREDIT_ENDDATE_DIFF'] = bureau['DAYS_CREDIT'] - bureau['DAYS_CREDIT_ENDDATE']

# 채무 금액 대비/대출 금액 비율 및 차이 가공

bureau['BUREAU_CREDIT_DEBT_RATIO'] = bureau['AMT_CREDIT_SUM_DEBT'] / bureau['AMT_CREDIT_SUM']

bureau['BUREAU_CREDIT_DEBT_DIFF'] = bureau['AMT_CREDIT_SUM_DEBT'] - bureau['AMT_CREDIT_SUM']bureau['AMT_CREDIT_SUM_DEBT'].value_counts().head(30) 0.0 1016434

4.5 653

-450.0 543

135000.0 344

90000.0 320

45000.0 316

22500.0 307

67500.0 238

225000.0 237

13500.0 205

450000.0 177

112500.0 156

18000.0 143

157500.0 139

27000.0 132

54000.0 125

9000.0 121

270000.0 107

22950.0 101

900000.0 98

675000.0 97

180000.0 97

9.0 94

225.0 88

-45.0 84

31500.0 84

36000.0 81

450.0 81

1350000.0 81

49500.0 81

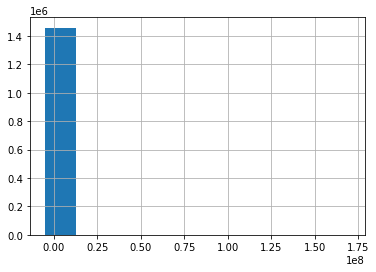

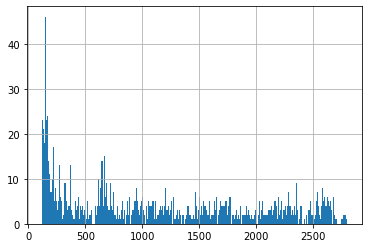

Name: AMT_CREDIT_SUM_DEBT, dtype: int64bureau['AMT_CREDIT_SUM_DEBT'].hist()

연체 일수 CREDIT_DAY_OVERDUE로 연체 관련 FE 수행.

# 연체 건수가 많지 않음.

bureau['CREDIT_DAY_OVERDUE'].value_counts()0 1712211

30 311

60 126

13 103

8 103

...

1548 1

1546 1

519 1

2565 1

372 1

Name: CREDIT_DAY_OVERDUE, Length: 942, dtype: int64연체일수가 0보다 큰건, 120보다 큰건 조사

bureau[bureau['CREDIT_DAY_OVERDUE'] > 120].shape(1143, 22)bureau[bureau['CREDIT_DAY_OVERDUE'] > 120]['CREDIT_DAY_OVERDUE'].hist(bins=300)

연체일수에 따라 연체인지, 연체가 120일이상인지 컬럼 가공

bureau['BUREAU_IS_DPD'] = bureau['CREDIT_DAY_OVERDUE'].apply(lambda x: 1 if x > 0 else 0)

bureau['BUREAU_IS_DPD'].value_counts()0 1712211

1 4217

Name: BUREAU_IS_DPD, dtype: int64bureau['BUREAU_IS_DPD_OVER120'] = bureau['CREDIT_DAY_OVERDUE'].apply(lambda x: 1 if x >120 else 0)

bureau['BUREAU_IS_DPD_OVER120'].value_counts()0 1715285

1 1143

Name: BUREAU_IS_DPD_OVER120, dtype: int64기존 주요 bureau 컬럼 및 앞에서 가공한 컬럼으로 주요 aggregation 컬럼 생성.

bureau_agg_dict = {

# 기존 컬럼

'SK_ID_BUREAU':['count'],

'DAYS_CREDIT':['min', 'max', 'mean'],

'CREDIT_DAY_OVERDUE':['min', 'max', 'mean'],

'DAYS_CREDIT_ENDDATE':['min', 'max', 'mean'],

'DAYS_ENDDATE_FACT':['min', 'max', 'mean'],

'AMT_CREDIT_MAX_OVERDUE': ['max', 'mean'],

'AMT_CREDIT_SUM': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_DEBT': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_OVERDUE': ['max', 'mean', 'sum'],

'AMT_ANNUITY': ['max', 'mean', 'sum'],

# 추가 가공 컬럼

'BUREAU_ENDDATE_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_ENDDATE_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_RATIO':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_DIFF':['min', 'max', 'mean'],

'BUREAU_IS_DPD':['mean', 'sum'],

'BUREAU_IS_DPD_OVER120':['mean', 'sum']

}

bureau_grp = bureau.groupby('SK_ID_CURR')

bureau_day_amt_agg = bureau_grp.agg(bureau_agg_dict)

# BUREAU_ 접두어로 하는 새로운 컬럼명 할당.

bureau_day_amt_agg.columns = ['BUREAU_'+('_').join(column).upper() for column in bureau_day_amt_agg.columns.ravel()]

# 조인을 위해 SK_ID_CURR을 reset_index()로 컬럼화

bureau_day_amt_agg = bureau_day_amt_agg.reset_index()

print(bureau_day_amt_agg.shape)

(305811, 47)bureau_day_amt_agg.head(10)| SK_ID_CURR | BUREAU_SK_ID_BUREAU_COUNT | BUREAU_DAYS_CREDIT_MIN | BUREAU_DAYS_CREDIT_MAX | BUREAU_DAYS_CREDIT_MEAN | BUREAU_CREDIT_DAY_OVERDUE_MIN | BUREAU_CREDIT_DAY_OVERDUE_MAX | BUREAU_CREDIT_DAY_OVERDUE_MEAN | BUREAU_DAYS_CREDIT_ENDDATE_MIN | BUREAU_DAYS_CREDIT_ENDDATE_MAX | BUREAU_DAYS_CREDIT_ENDDATE_MEAN | BUREAU_DAYS_ENDDATE_FACT_MIN | BUREAU_DAYS_ENDDATE_FACT_MAX | BUREAU_DAYS_ENDDATE_FACT_MEAN | BUREAU_AMT_CREDIT_MAX_OVERDUE_MAX | BUREAU_AMT_CREDIT_MAX_OVERDUE_MEAN | BUREAU_AMT_CREDIT_SUM_MAX | BUREAU_AMT_CREDIT_SUM_MEAN | BUREAU_AMT_CREDIT_SUM_SUM | BUREAU_AMT_CREDIT_SUM_DEBT_MAX | BUREAU_AMT_CREDIT_SUM_DEBT_MEAN | BUREAU_AMT_CREDIT_SUM_DEBT_SUM | BUREAU_AMT_CREDIT_SUM_OVERDUE_MAX | BUREAU_AMT_CREDIT_SUM_OVERDUE_MEAN | BUREAU_AMT_CREDIT_SUM_OVERDUE_SUM | BUREAU_AMT_ANNUITY_MAX | BUREAU_AMT_ANNUITY_MEAN | BUREAU_AMT_ANNUITY_SUM | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MIN | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MAX | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MEAN | BUREAU_BUREAU_CREDIT_FACT_DIFF_MIN | BUREAU_BUREAU_CREDIT_FACT_DIFF_MAX | BUREAU_BUREAU_CREDIT_FACT_DIFF_MEAN | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MIN | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MAX | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MEAN | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MIN | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MAX | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MEAN | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MIN | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MAX | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MEAN | BUREAU_BUREAU_IS_DPD_MEAN | BUREAU_BUREAU_IS_DPD_SUM | BUREAU_BUREAU_IS_DPD_OVER120_MEAN | BUREAU_BUREAU_IS_DPD_OVER120_SUM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 7 | -1572 | -49 | -735.000000 | 0 | 0 | 0.0 | -1329.0 | 1778.0 | 82.428571 | -1328.0 | -544.0 | -825.500000 | NaN | NaN | 378000.0 | 207623.571429 | 1453365.000 | 373239.0 | 85240.928571 | 596686.5 | 0.0 | 0.0 | 0.0 | 10822.5 | 3545.357143 | 24817.5 | -1.0 | 698.0 | 197.000000 | -335.0 | -32.0 | -228.750000 | -1827.0 | -243.0 | -817.428571 | 0.0 | 0.987405 | 0.282518 | -279720.0 | -4761.0 | -122382.642857 | 0.0 | 0 | 0.0 | 0 |

| 1 | 100002 | 8 | -1437 | -103 | -874.000000 | 0 | 0 | 0.0 | -1072.0 | 780.0 | -349.000000 | -1185.0 | -36.0 | -697.500000 | 5043.645 | 1681.029 | 450000.0 | 108131.945625 | 865055.565 | 245781.0 | 49156.200000 | 245781.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000 | 0.0 | 0.0 | 1029.0 | 252.600000 | -609.0 | -76.0 | -277.000000 | -1822.0 | -87.0 | -719.833333 | 0.0 | 0.546180 | 0.136545 | -204219.0 | 0.0 | -98388.513000 | 0.0 | 0 | 0.0 | 0 |

| 2 | 100003 | 4 | -2586 | -606 | -1400.750000 | 0 | 0 | 0.0 | -2434.0 | 1216.0 | -544.500000 | -2131.0 | -540.0 | -1097.333333 | 0.000 | 0.000 | 810000.0 | 254350.125000 | 1017400.500 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -303.0 | 201.0 | -34.000000 | -1096.0 | -154.0 | -568.333333 | -1822.0 | -152.0 | -856.250000 | 0.0 | 0.000000 | 0.000000 | -810000.0 | -22248.0 | -254350.125000 | 0.0 | 0 | 0.0 | 0 |

| 3 | 100004 | 2 | -1326 | -408 | -867.000000 | 0 | 0 | 0.0 | -595.0 | -382.0 | -488.500000 | -683.0 | -382.0 | -532.500000 | 0.000 | 0.000 | 94537.8 | 94518.900000 | 189037.800 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 88.0 | 44.000000 | -643.0 | -26.0 | -334.500000 | -731.0 | -26.0 | -378.500000 | 0.0 | 0.000000 | 0.000000 | -94537.8 | -94500.0 | -94518.900000 | 0.0 | 0 | 0.0 | 0 |

| 4 | 100005 | 3 | -373 | -62 | -190.666667 | 0 | 0 | 0.0 | -128.0 | 1324.0 | 439.333333 | -123.0 | -123.0 | -123.000000 | 0.000 | 0.000 | 568800.0 | 219042.000000 | 657126.000 | 543087.0 | 189469.500000 | 568408.5 | 0.0 | 0.0 | 0.0 | 4261.5 | 1420.500000 | 4261.5 | -5.0 | -5.0 | -5.000000 | -250.0 | -250.0 | -250.000000 | -1461.0 | -184.0 | -630.000000 | 0.0 | 0.954794 | 0.601256 | -58500.0 | -4504.5 | -29572.500000 | 0.0 | 0 | 0.0 | 0 |

| 5 | 100007 | 1 | -1149 | -1149 | -1149.000000 | 0 | 0 | 0.0 | -783.0 | -783.0 | -783.000000 | -783.0 | -783.0 | -783.000000 | 0.000 | 0.000 | 146250.0 | 146250.000000 | 146250.000 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 0.0 | 0.000000 | -366.0 | -366.0 | -366.000000 | -366.0 | -366.0 | -366.000000 | 0.0 | 0.000000 | 0.000000 | -146250.0 | -146250.0 | -146250.000000 | 0.0 | 0 | 0.0 | 0 |

| 6 | 100008 | 3 | -1097 | -78 | -757.333333 | 0 | 0 | 0.0 | -853.0 | 471.0 | -391.333333 | -1028.0 | -790.0 | -909.000000 | 0.000 | 0.000 | 267606.0 | 156148.500000 | 468445.500 | 240057.0 | 80019.000000 | 240057.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -2.0 | 175.0 | 86.500000 | -307.0 | -69.0 | -188.000000 | -549.0 | -244.0 | -366.000000 | 0.0 | 0.897054 | 0.299018 | -105705.0 | -27549.0 | -76129.500000 | 0.0 | 0 | 0.0 | 0 |

| 7 | 100009 | 18 | -2882 | -239 | -1271.500000 | 0 | 0 | 0.0 | -2152.0 | 1402.0 | -794.937500 | -2152.0 | -313.0 | -1108.500000 | 0.000 | 0.000 | 1777500.0 | 266711.750000 | 4800811.500 | 557959.5 | 76953.535714 | 1077349.5 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -713.0 | 1459.0 | 114.785714 | -893.0 | -92.0 | -357.214286 | -1826.0 | -30.0 | -529.000000 | 0.0 | 0.967787 | 0.169369 | -1777500.0 | -10872.0 | -227088.000000 | 0.0 | 0 | 0.0 | 0 |

| 8 | 100010 | 2 | -2741 | -1138 | -1939.500000 | 0 | 0 | 0.0 | -928.0 | 689.0 | -119.500000 | -1138.0 | -1138.0 | -1138.000000 | NaN | NaN | 675000.0 | 495000.000000 | 990000.000 | 348007.5 | 174003.750000 | 348007.5 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 210.0 | 210.0 | 210.000000 | -1603.0 | -1603.0 | -1603.000000 | -1827.0 | -1813.0 | -1820.000000 | 0.0 | 0.515567 | 0.257783 | -326992.5 | -315000.0 | -320996.250000 | 0.0 | 0 | 0.0 | 0 |

| 9 | 100011 | 4 | -2508 | -1309 | -1773.000000 | 0 | 0 | 0.0 | -2173.0 | -860.0 | -1293.250000 | -2197.0 | -968.0 | -1463.250000 | 10147.230 | 5073.615 | 145242.0 | 108807.075000 | 435228.300 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -102.0 | 758.0 | 170.000000 | -347.0 | -239.0 | -309.750000 | -1100.0 | -239.0 | -479.750000 | 0.0 | 0.000000 | 0.000000 | -145242.0 | -54000.0 | -96662.100000 | 0.0 | 0 | 0.0 | 0 |

현재 대출 중 Active인 건만 별도로 Group by 수행(CREDIT_ACTIVE='Active')

cond_active = bureau['CREDIT_ACTIVE'] == 'Active'

bureau_active_grp = bureau[cond_active].groupby('SK_ID_CURR')

bureau_agg_dict = {

# 기존 컬럼

'SK_ID_BUREAU':['count'],

'DAYS_CREDIT':['min', 'max', 'mean'],

'CREDIT_DAY_OVERDUE':['min', 'max', 'mean'],

'DAYS_CREDIT_ENDDATE':['min', 'max', 'mean'],

'DAYS_ENDDATE_FACT':['min', 'max', 'mean'],

'AMT_CREDIT_MAX_OVERDUE': ['max', 'mean'],

'AMT_CREDIT_SUM': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_DEBT': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_OVERDUE': ['max', 'mean', 'sum'],

'AMT_ANNUITY': ['max', 'mean', 'sum'],

# 추가 가공 컬럼

'BUREAU_ENDDATE_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_ENDDATE_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_RATIO':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_DIFF':['min', 'max', 'mean'],

'BUREAU_IS_DPD':['mean', 'sum'],

'BUREAU_IS_DPD_OVER120':['mean', 'sum']

}

bureau_active_agg = bureau_active_grp.agg(bureau_agg_dict)

# BUREAU_ACT을 접두어로 하는 새로운 컬럼명 할당.

bureau_active_agg.columns = ['BUREAU_ACT_'+('_').join(column).upper() for column in bureau_active_agg.columns.ravel()]

# 조인을 위해 SK_ID_CURR을 reset_index()로 컬럼화

bureau_active_agg = bureau_active_agg.reset_index()

print(bureau_active_agg.shape)

bureau_active_agg.head(10)

(251815, 47)| SK_ID_CURR | BUREAU_ACT_SK_ID_BUREAU_COUNT | BUREAU_ACT_DAYS_CREDIT_MIN | BUREAU_ACT_DAYS_CREDIT_MAX | BUREAU_ACT_DAYS_CREDIT_MEAN | BUREAU_ACT_CREDIT_DAY_OVERDUE_MIN | BUREAU_ACT_CREDIT_DAY_OVERDUE_MAX | BUREAU_ACT_CREDIT_DAY_OVERDUE_MEAN | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MIN | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MAX | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MEAN | BUREAU_ACT_DAYS_ENDDATE_FACT_MIN | BUREAU_ACT_DAYS_ENDDATE_FACT_MAX | BUREAU_ACT_DAYS_ENDDATE_FACT_MEAN | BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MAX | BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_MAX | BUREAU_ACT_AMT_CREDIT_SUM_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_SUM | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MAX | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_SUM | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MAX | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_SUM | BUREAU_ACT_AMT_ANNUITY_MAX | BUREAU_ACT_AMT_ANNUITY_MEAN | BUREAU_ACT_AMT_ANNUITY_SUM | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MIN | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MAX | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MIN | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MAX | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MEAN | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MEAN | BUREAU_ACT_BUREAU_IS_DPD_MEAN | BUREAU_ACT_BUREAU_IS_DPD_SUM | BUREAU_ACT_BUREAU_IS_DPD_OVER120_MEAN | BUREAU_ACT_BUREAU_IS_DPD_OVER120_SUM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 3 | -559 | -49 | -309.333333 | 0 | 0 | 0.0 | 411.0 | 1778.0 | 1030.333333 | NaN | NaN | NaN | NaN | NaN | 378000.0 | 294675.0000 | 884025.000 | 373239.00 | 198895.500 | 596686.50 | 0.0 | 0.0 | 0.0 | 10822.5 | 8272.50 | 24817.5 | NaN | NaN | NaN | NaN | NaN | NaN | -1827.0 | -731.0 | -1339.666667 | 0.335128 | 0.987405 | 0.659208 | -224514.0 | -4761.000 | -95779.5000 | 0.0 | 0 | 0.0 | 0 |

| 1 | 100002 | 2 | -1042 | -103 | -572.500000 | 0 | 0 | 0.0 | 780.0 | 780.0 | 780.000000 | NaN | NaN | NaN | 40.50 | 40.50 | 450000.0 | 240994.2825 | 481988.565 | 245781.00 | 122890.500 | 245781.00 | 0.0 | 0.0 | 0.0 | 0.0 | 0.00 | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1822.0 | -1822.0 | -1822.000000 | 0.000000 | 0.546180 | 0.273090 | -204219.0 | -31988.565 | -118103.7825 | 0.0 | 0 | 0.0 | 0 |

| 2 | 100003 | 1 | -606 | -606 | -606.000000 | 0 | 0 | 0.0 | 1216.0 | 1216.0 | 1216.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 810000.0 | 810000.0000 | 810000.000 | 0.00 | 0.000 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1822.0 | -1822.0 | -1822.000000 | 0.000000 | 0.000000 | 0.000000 | -810000.0 | -810000.000 | -810000.0000 | 0.0 | 0 | 0.0 | 0 |

| 3 | 100005 | 2 | -137 | -62 | -99.500000 | 0 | 0 | 0.0 | 122.0 | 1324.0 | 723.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 568800.0 | 299313.0000 | 598626.000 | 543087.00 | 284204.250 | 568408.50 | 0.0 | 0.0 | 0.0 | 4261.5 | 2130.75 | 4261.5 | NaN | NaN | NaN | NaN | NaN | NaN | -1461.0 | -184.0 | -822.500000 | 0.848974 | 0.954794 | 0.901884 | -25713.0 | -4504.500 | -15108.7500 | 0.0 | 0 | 0.0 | 0 |

| 4 | 100008 | 1 | -78 | -78 | -78.000000 | 0 | 0 | 0.0 | 471.0 | 471.0 | 471.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 267606.0 | 267606.0000 | 267606.000 | 240057.00 | 240057.000 | 240057.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -549.0 | -549.0 | -549.000000 | 0.897054 | 0.897054 | 0.897054 | -27549.0 | -27549.000 | -27549.0000 | 0.0 | 0 | 0.0 | 0 |

| 5 | 100009 | 4 | -1293 | -239 | -591.750000 | 0 | 0 | 0.0 | -209.0 | 1402.0 | 596.500000 | NaN | NaN | NaN | NaN | NaN | 642861.0 | 381890.2500 | 1527561.000 | 557959.50 | 269337.375 | 1077349.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1826.0 | -30.0 | -928.000000 | 0.000000 | 0.967787 | 0.592792 | -187200.0 | -10872.000 | -112552.8750 | 0.0 | 0 | 0.0 | 0 |

| 6 | 100010 | 1 | -1138 | -1138 | -1138.000000 | 0 | 0 | 0.0 | 689.0 | 689.0 | 689.000000 | NaN | NaN | NaN | NaN | NaN | 675000.0 | 675000.0000 | 675000.000 | 348007.50 | 348007.500 | 348007.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1827.0 | -1827.0 | -1827.000000 | 0.515567 | 0.515567 | 0.515567 | -326992.5 | -326992.500 | -326992.5000 | 0.0 | 0 | 0.0 | 0 |

| 7 | 100014 | 2 | -423 | -376 | -399.500000 | 0 | 0 | 0.0 | 704.0 | 723.0 | 713.500000 | NaN | NaN | NaN | 12752.28 | 6376.14 | 571500.0 | 502875.0000 | 1005750.000 | 420201.00 | 379107.000 | 758214.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1127.0 | -1099.0 | -1113.000000 | 0.735260 | 0.778383 | 0.756822 | -151299.0 | -96237.000 | -123768.0000 | 0.0 | 0 | 0.0 | 0 |

| 8 | 100016 | 4 | -262 | -128 | -168.250000 | 0 | 0 | 0.0 | 223.0 | 845.0 | 381.750000 | NaN | NaN | NaN | NaN | NaN | 91264.5 | 84189.3750 | 336757.500 | 63724.50 | 31862.250 | 63724.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1107.0 | -364.0 | -550.000000 | 0.000000 | 0.716034 | 0.358017 | -67500.0 | -25272.000 | -46386.0000 | 0.0 | 0 | 0.0 | 0 |

| 9 | 100019 | 2 | -495 | -495 | -495.000000 | 0 | 0 | 0.0 | 419.0 | 10463.0 | 5441.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 450000.0 | 360000.0000 | 720000.000 | 245470.14 | 122735.070 | 245470.14 | 0.0 | 0.0 | 0.0 | 27000.0 | 27000.00 | 54000.0 | NaN | NaN | NaN | NaN | NaN | NaN | -10958.0 | -914.0 | -5936.000000 | 0.000000 | 0.545489 | 0.272745 | -270000.0 | -204529.860 | -237264.9300 | 0.0 | 0 | 0.0 | 0 |

bureau_agg = bureau_day_amt_agg.merge(bureau_active_agg, on='SK_ID_CURR', how='left')

bureau_agg.head(20)| SK_ID_CURR | BUREAU_SK_ID_BUREAU_COUNT | BUREAU_DAYS_CREDIT_MIN | BUREAU_DAYS_CREDIT_MAX | BUREAU_DAYS_CREDIT_MEAN | BUREAU_CREDIT_DAY_OVERDUE_MIN | BUREAU_CREDIT_DAY_OVERDUE_MAX | BUREAU_CREDIT_DAY_OVERDUE_MEAN | BUREAU_DAYS_CREDIT_ENDDATE_MIN | BUREAU_DAYS_CREDIT_ENDDATE_MAX | BUREAU_DAYS_CREDIT_ENDDATE_MEAN | BUREAU_DAYS_ENDDATE_FACT_MIN | BUREAU_DAYS_ENDDATE_FACT_MAX | BUREAU_DAYS_ENDDATE_FACT_MEAN | BUREAU_AMT_CREDIT_MAX_OVERDUE_MAX | BUREAU_AMT_CREDIT_MAX_OVERDUE_MEAN | BUREAU_AMT_CREDIT_SUM_MAX | BUREAU_AMT_CREDIT_SUM_MEAN | BUREAU_AMT_CREDIT_SUM_SUM | BUREAU_AMT_CREDIT_SUM_DEBT_MAX | BUREAU_AMT_CREDIT_SUM_DEBT_MEAN | BUREAU_AMT_CREDIT_SUM_DEBT_SUM | BUREAU_AMT_CREDIT_SUM_OVERDUE_MAX | BUREAU_AMT_CREDIT_SUM_OVERDUE_MEAN | BUREAU_AMT_CREDIT_SUM_OVERDUE_SUM | BUREAU_AMT_ANNUITY_MAX | BUREAU_AMT_ANNUITY_MEAN | BUREAU_AMT_ANNUITY_SUM | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MIN | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MAX | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MEAN | BUREAU_BUREAU_CREDIT_FACT_DIFF_MIN | BUREAU_BUREAU_CREDIT_FACT_DIFF_MAX | BUREAU_BUREAU_CREDIT_FACT_DIFF_MEAN | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MIN | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MAX | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MEAN | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MIN | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MAX | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MEAN | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MIN | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MAX | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MEAN | BUREAU_BUREAU_IS_DPD_MEAN | BUREAU_BUREAU_IS_DPD_SUM | BUREAU_BUREAU_IS_DPD_OVER120_MEAN | BUREAU_BUREAU_IS_DPD_OVER120_SUM | BUREAU_ACT_SK_ID_BUREAU_COUNT | BUREAU_ACT_DAYS_CREDIT_MIN | BUREAU_ACT_DAYS_CREDIT_MAX | BUREAU_ACT_DAYS_CREDIT_MEAN | BUREAU_ACT_CREDIT_DAY_OVERDUE_MIN | BUREAU_ACT_CREDIT_DAY_OVERDUE_MAX | BUREAU_ACT_CREDIT_DAY_OVERDUE_MEAN | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MIN | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MAX | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MEAN | BUREAU_ACT_DAYS_ENDDATE_FACT_MIN | BUREAU_ACT_DAYS_ENDDATE_FACT_MAX | BUREAU_ACT_DAYS_ENDDATE_FACT_MEAN | BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MAX | BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_MAX | BUREAU_ACT_AMT_CREDIT_SUM_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_SUM | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MAX | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_SUM | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MAX | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_SUM | BUREAU_ACT_AMT_ANNUITY_MAX | BUREAU_ACT_AMT_ANNUITY_MEAN | BUREAU_ACT_AMT_ANNUITY_SUM | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MIN | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MAX | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MIN | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MAX | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MEAN | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MEAN | BUREAU_ACT_BUREAU_IS_DPD_MEAN | BUREAU_ACT_BUREAU_IS_DPD_SUM | BUREAU_ACT_BUREAU_IS_DPD_OVER120_MEAN | BUREAU_ACT_BUREAU_IS_DPD_OVER120_SUM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 7 | -1572 | -49 | -735.000000 | 0 | 0 | 0.0 | -1329.0 | 1778.0 | 82.428571 | -1328.0 | -544.0 | -825.500000 | NaN | NaN | 378000.0 | 2.076236e+05 | 1453365.000 | 373239.00 | 8.524093e+04 | 596686.50 | 0.0 | 0.0 | 0.0 | 10822.5 | 3545.357143 | 24817.5 | -1.0 | 698.0 | 197.000000 | -335.0 | -32.0 | -228.750000 | -1827.0 | -243.0 | -817.428571 | 0.000000 | 0.987405 | 0.282518 | -279720.00 | -4761.00 | -122382.642857 | 0.0 | 0 | 0.0 | 0 | 3.0 | -559.0 | -49.0 | -309.333333 | 0.0 | 0.0 | 0.0 | 411.0 | 1778.0 | 1030.333333 | NaN | NaN | NaN | NaN | NaN | 378000.0 | 2.946750e+05 | 884025.000 | 373239.00 | 198895.500 | 596686.50 | 0.0 | 0.0 | 0.0 | 10822.5 | 8272.50 | 24817.5 | NaN | NaN | NaN | NaN | NaN | NaN | -1827.0 | -731.0 | -1339.666667 | 0.335128 | 0.987405 | 0.659208 | -224514.0 | -4761.000 | -95779.5000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 1 | 100002 | 8 | -1437 | -103 | -874.000000 | 0 | 0 | 0.0 | -1072.0 | 780.0 | -349.000000 | -1185.0 | -36.0 | -697.500000 | 5043.645 | 1681.0290 | 450000.0 | 1.081319e+05 | 865055.565 | 245781.00 | 4.915620e+04 | 245781.00 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000 | 0.0 | 0.0 | 1029.0 | 252.600000 | -609.0 | -76.0 | -277.000000 | -1822.0 | -87.0 | -719.833333 | 0.000000 | 0.546180 | 0.136545 | -204219.00 | 0.00 | -98388.513000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -1042.0 | -103.0 | -572.500000 | 0.0 | 0.0 | 0.0 | 780.0 | 780.0 | 780.000000 | NaN | NaN | NaN | 40.50 | 40.50 | 450000.0 | 2.409943e+05 | 481988.565 | 245781.00 | 122890.500 | 245781.00 | 0.0 | 0.0 | 0.0 | 0.0 | 0.00 | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1822.0 | -1822.0 | -1822.000000 | 0.000000 | 0.546180 | 0.273090 | -204219.0 | -31988.565 | -118103.7825 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2 | 100003 | 4 | -2586 | -606 | -1400.750000 | 0 | 0 | 0.0 | -2434.0 | 1216.0 | -544.500000 | -2131.0 | -540.0 | -1097.333333 | 0.000 | 0.0000 | 810000.0 | 2.543501e+05 | 1017400.500 | 0.00 | 0.000000e+00 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -303.0 | 201.0 | -34.000000 | -1096.0 | -154.0 | -568.333333 | -1822.0 | -152.0 | -856.250000 | 0.000000 | 0.000000 | 0.000000 | -810000.00 | -22248.00 | -254350.125000 | 0.0 | 0 | 0.0 | 0 | 1.0 | -606.0 | -606.0 | -606.000000 | 0.0 | 0.0 | 0.0 | 1216.0 | 1216.0 | 1216.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 810000.0 | 8.100000e+05 | 810000.000 | 0.00 | 0.000 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1822.0 | -1822.0 | -1822.000000 | 0.000000 | 0.000000 | 0.000000 | -810000.0 | -810000.000 | -810000.0000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 3 | 100004 | 2 | -1326 | -408 | -867.000000 | 0 | 0 | 0.0 | -595.0 | -382.0 | -488.500000 | -683.0 | -382.0 | -532.500000 | 0.000 | 0.0000 | 94537.8 | 9.451890e+04 | 189037.800 | 0.00 | 0.000000e+00 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 88.0 | 44.000000 | -643.0 | -26.0 | -334.500000 | -731.0 | -26.0 | -378.500000 | 0.000000 | 0.000000 | 0.000000 | -94537.80 | -94500.00 | -94518.900000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 4 | 100005 | 3 | -373 | -62 | -190.666667 | 0 | 0 | 0.0 | -128.0 | 1324.0 | 439.333333 | -123.0 | -123.0 | -123.000000 | 0.000 | 0.0000 | 568800.0 | 2.190420e+05 | 657126.000 | 543087.00 | 1.894695e+05 | 568408.50 | 0.0 | 0.0 | 0.0 | 4261.5 | 1420.500000 | 4261.5 | -5.0 | -5.0 | -5.000000 | -250.0 | -250.0 | -250.000000 | -1461.0 | -184.0 | -630.000000 | 0.000000 | 0.954794 | 0.601256 | -58500.00 | -4504.50 | -29572.500000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -137.0 | -62.0 | -99.500000 | 0.0 | 0.0 | 0.0 | 122.0 | 1324.0 | 723.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 568800.0 | 2.993130e+05 | 598626.000 | 543087.00 | 284204.250 | 568408.50 | 0.0 | 0.0 | 0.0 | 4261.5 | 2130.75 | 4261.5 | NaN | NaN | NaN | NaN | NaN | NaN | -1461.0 | -184.0 | -822.500000 | 0.848974 | 0.954794 | 0.901884 | -25713.0 | -4504.500 | -15108.7500 | 0.0 | 0.0 | 0.0 | 0.0 |

| 5 | 100007 | 1 | -1149 | -1149 | -1149.000000 | 0 | 0 | 0.0 | -783.0 | -783.0 | -783.000000 | -783.0 | -783.0 | -783.000000 | 0.000 | 0.0000 | 146250.0 | 1.462500e+05 | 146250.000 | 0.00 | 0.000000e+00 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 0.0 | 0.000000 | -366.0 | -366.0 | -366.000000 | -366.0 | -366.0 | -366.000000 | 0.000000 | 0.000000 | 0.000000 | -146250.00 | -146250.00 | -146250.000000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 6 | 100008 | 3 | -1097 | -78 | -757.333333 | 0 | 0 | 0.0 | -853.0 | 471.0 | -391.333333 | -1028.0 | -790.0 | -909.000000 | 0.000 | 0.0000 | 267606.0 | 1.561485e+05 | 468445.500 | 240057.00 | 8.001900e+04 | 240057.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -2.0 | 175.0 | 86.500000 | -307.0 | -69.0 | -188.000000 | -549.0 | -244.0 | -366.000000 | 0.000000 | 0.897054 | 0.299018 | -105705.00 | -27549.00 | -76129.500000 | 0.0 | 0 | 0.0 | 0 | 1.0 | -78.0 | -78.0 | -78.000000 | 0.0 | 0.0 | 0.0 | 471.0 | 471.0 | 471.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 267606.0 | 2.676060e+05 | 267606.000 | 240057.00 | 240057.000 | 240057.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -549.0 | -549.0 | -549.000000 | 0.897054 | 0.897054 | 0.897054 | -27549.0 | -27549.000 | -27549.0000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 7 | 100009 | 18 | -2882 | -239 | -1271.500000 | 0 | 0 | 0.0 | -2152.0 | 1402.0 | -794.937500 | -2152.0 | -313.0 | -1108.500000 | 0.000 | 0.0000 | 1777500.0 | 2.667118e+05 | 4800811.500 | 557959.50 | 7.695354e+04 | 1077349.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -713.0 | 1459.0 | 114.785714 | -893.0 | -92.0 | -357.214286 | -1826.0 | -30.0 | -529.000000 | 0.000000 | 0.967787 | 0.169369 | -1777500.00 | -10872.00 | -227088.000000 | 0.0 | 0 | 0.0 | 0 | 4.0 | -1293.0 | -239.0 | -591.750000 | 0.0 | 0.0 | 0.0 | -209.0 | 1402.0 | 596.500000 | NaN | NaN | NaN | NaN | NaN | 642861.0 | 3.818902e+05 | 1527561.000 | 557959.50 | 269337.375 | 1077349.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1826.0 | -30.0 | -928.000000 | 0.000000 | 0.967787 | 0.592792 | -187200.0 | -10872.000 | -112552.8750 | 0.0 | 0.0 | 0.0 | 0.0 |

| 8 | 100010 | 2 | -2741 | -1138 | -1939.500000 | 0 | 0 | 0.0 | -928.0 | 689.0 | -119.500000 | -1138.0 | -1138.0 | -1138.000000 | NaN | NaN | 675000.0 | 4.950000e+05 | 990000.000 | 348007.50 | 1.740038e+05 | 348007.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 210.0 | 210.0 | 210.000000 | -1603.0 | -1603.0 | -1603.000000 | -1827.0 | -1813.0 | -1820.000000 | 0.000000 | 0.515567 | 0.257783 | -326992.50 | -315000.00 | -320996.250000 | 0.0 | 0 | 0.0 | 0 | 1.0 | -1138.0 | -1138.0 | -1138.000000 | 0.0 | 0.0 | 0.0 | 689.0 | 689.0 | 689.000000 | NaN | NaN | NaN | NaN | NaN | 675000.0 | 6.750000e+05 | 675000.000 | 348007.50 | 348007.500 | 348007.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1827.0 | -1827.0 | -1827.000000 | 0.515567 | 0.515567 | 0.515567 | -326992.5 | -326992.500 | -326992.5000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 9 | 100011 | 4 | -2508 | -1309 | -1773.000000 | 0 | 0 | 0.0 | -2173.0 | -860.0 | -1293.250000 | -2197.0 | -968.0 | -1463.250000 | 10147.230 | 5073.6150 | 145242.0 | 1.088071e+05 | 435228.300 | 0.00 | 0.000000e+00 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -102.0 | 758.0 | 170.000000 | -347.0 | -239.0 | -309.750000 | -1100.0 | -239.0 | -479.750000 | 0.000000 | 0.000000 | 0.000000 | -145242.00 | -54000.00 | -96662.100000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 10 | 100013 | 4 | -2070 | -1210 | -1737.500000 | 0 | 0 | 0.0 | -1707.0 | -567.0 | -1068.000000 | -1334.0 | -549.0 | -1054.750000 | 19305.000 | 19305.0000 | 1262250.0 | 5.180700e+05 | 2072280.060 | 0.00 | 0.000000e+00 | 0.00 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000 | 0.0 | -489.0 | 425.0 | -13.250000 | -1116.0 | -92.0 | -682.750000 | -1098.0 | -121.0 | -669.500000 | 0.000000 | 0.000000 | 0.000000 | -26490.06 | -26490.06 | -26490.060000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 11 | 100014 | 8 | -2308 | -376 | -1095.375000 | 0 | 0 | 0.0 | -2004.0 | 723.0 | -387.375000 | -1992.0 | -346.0 | -821.333333 | 12752.280 | 3726.3525 | 900000.0 | 3.412416e+05 | 2729932.425 | 420201.00 | 1.516428e+05 | 758214.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -29.0 | 469.0 | 67.000000 | -1357.0 | -89.0 | -506.000000 | -1826.0 | -60.0 | -708.000000 | 0.000000 | 0.778383 | 0.302729 | -900000.00 | -96237.00 | -343778.985000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -423.0 | -376.0 | -399.500000 | 0.0 | 0.0 | 0.0 | 704.0 | 723.0 | 713.500000 | NaN | NaN | NaN | 12752.28 | 6376.14 | 571500.0 | 5.028750e+05 | 1005750.000 | 420201.00 | 379107.000 | 758214.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1127.0 | -1099.0 | -1113.000000 | 0.735260 | 0.778383 | 0.756822 | -151299.0 | -96237.000 | -123768.0000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 12 | 100015 | 4 | -1409 | -319 | -947.750000 | 0 | 0 | 0.0 | -1045.0 | -16.0 | -598.250000 | -907.0 | -8.0 | -555.500000 | NaN | NaN | 131103.0 | 1.023739e+05 | 409495.500 | 0.00 | 0.000000e+00 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -138.0 | 0.0 | -42.750000 | -502.0 | -311.0 | -392.250000 | -366.0 | -303.0 | -349.500000 | 0.000000 | 0.000000 | 0.000000 | -94320.00 | -94320.00 | -94320.000000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 13 | 100016 | 7 | -1634 | -128 | -618.428571 | 0 | 0 | 0.0 | -1369.0 | 845.0 | -217.142857 | -1369.0 | -347.0 | -929.666667 | 0.000 | 0.0000 | 91264.5 | 6.785486e+04 | 474984.000 | 63724.50 | 1.274490e+04 | 63724.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -258.0 | 0.0 | -86.000000 | -561.0 | -125.0 | -289.000000 | -1107.0 | -125.0 | -401.285714 | 0.000000 | 0.716034 | 0.143207 | -67500.00 | -22086.00 | -46199.700000 | 0.0 | 0 | 0.0 | 0 | 4.0 | -262.0 | -128.0 | -168.250000 | 0.0 | 0.0 | 0.0 | 223.0 | 845.0 | 381.750000 | NaN | NaN | NaN | NaN | NaN | 91264.5 | 8.418938e+04 | 336757.500 | 63724.50 | 31862.250 | 63724.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1107.0 | -364.0 | -550.000000 | 0.000000 | 0.716034 | 0.358017 | -67500.0 | -25272.000 | -46386.0000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 14 | 100017 | 6 | -2881 | -909 | -1944.333333 | 0 | 0 | 0.0 | -2546.0 | 197.0 | -1512.333333 | -2575.0 | -738.0 | -1677.833333 | 0.000 | 0.0000 | 315000.0 | 1.432950e+05 | 859770.000 | 0.00 | 0.000000e+00 | 0.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 935.0 | 165.500000 | -366.0 | -139.0 | -266.500000 | -1106.0 | -139.0 | -432.000000 | 0.000000 | 0.000000 | 0.000000 | -225000.00 | -63990.00 | -132073.500000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 15 | 100019 | 2 | -495 | -495 | -495.000000 | 0 | 0 | 0.0 | 419.0 | 10463.0 | 5441.000000 | NaN | NaN | NaN | 0.000 | 0.0000 | 450000.0 | 3.600000e+05 | 720000.000 | 245470.14 | 1.227351e+05 | 245470.14 | 0.0 | 0.0 | 0.0 | 27000.0 | 27000.000000 | 54000.0 | NaN | NaN | NaN | NaN | NaN | NaN | -10958.0 | -914.0 | -5936.000000 | 0.000000 | 0.545489 | 0.272745 | -270000.00 | -204529.86 | -237264.930000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -495.0 | -495.0 | -495.000000 | 0.0 | 0.0 | 0.0 | 419.0 | 10463.0 | 5441.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 450000.0 | 3.600000e+05 | 720000.000 | 245470.14 | 122735.070 | 245470.14 | 0.0 | 0.0 | 0.0 | 27000.0 | 27000.00 | 54000.0 | NaN | NaN | NaN | NaN | NaN | NaN | -10958.0 | -914.0 | -5936.000000 | 0.000000 | 0.545489 | 0.272745 | -270000.0 | -204529.860 | -237264.9300 | 0.0 | 0.0 | 0.0 | 0.0 |

| 16 | 100020 | 4 | -492 | -90 | -261.500000 | 0 | 0 | 0.0 | -311.0 | 277.0 | -32.500000 | -311.0 | -135.0 | -223.000000 | 0.000 | 0.0000 | 135000.0 | 4.987125e+04 | 199485.000 | 117243.00 | 3.077212e+04 | 123088.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 31.0 | 15.500000 | -181.0 | -153.0 | -167.000000 | -367.0 | -181.0 | -229.000000 | 0.000000 | 0.868467 | 0.307325 | -29160.00 | -10354.50 | -19099.125000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -176.0 | -90.0 | -133.000000 | 0.0 | 0.0 | 0.0 | 8.0 | 277.0 | 142.500000 | NaN | NaN | NaN | 0.00 | 0.00 | 135000.0 | 7.560000e+04 | 151200.000 | 117243.00 | 61544.250 | 123088.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -367.0 | -184.0 | -275.500000 | 0.360833 | 0.868467 | 0.614650 | -17757.0 | -10354.500 | -14055.7500 | 0.0 | 0.0 | 0.0 | 0.0 |

| 17 | 100022 | 2 | -385 | -289 | -337.000000 | 0 | 0 | 0.0 | 441.0 | 1439.0 | 940.000000 | NaN | NaN | NaN | 0.000 | 0.0000 | 765000.0 | 5.287500e+05 | 1057500.000 | 205276.50 | 2.052765e+05 | 205276.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1824.0 | -730.0 | -1277.000000 | 0.701800 | 0.701800 | 0.701800 | -87223.50 | -87223.50 | -87223.500000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -385.0 | -289.0 | -337.000000 | 0.0 | 0.0 | 0.0 | 441.0 | 1439.0 | 940.000000 | NaN | NaN | NaN | 0.00 | 0.00 | 765000.0 | 5.287500e+05 | 1057500.000 | 205276.50 | 205276.500 | 205276.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1824.0 | -730.0 | -1277.000000 | 0.701800 | 0.701800 | 0.701800 | -87223.5 | -87223.500 | -87223.5000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 18 | 100023 | 13 | -2624 | -157 | -1164.384615 | 0 | 0 | 0.0 | -2228.0 | 1669.0 | -364.916667 | -2335.0 | -138.0 | -997.300000 | 5980.050 | 2720.8500 | 444078.0 | 1.265917e+05 | 1645692.345 | 70443.00 | 1.370385e+04 | 137038.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -16.0 | 1456.0 | 287.111111 | -653.0 | -35.0 | -296.900000 | -1827.0 | -184.0 | -833.750000 | 0.000000 | 0.930700 | 0.188812 | -444078.00 | -3118.50 | -101004.934500 | 0.0 | 0 | 0.0 | 0 | 4.0 | -2370.0 | -157.0 | -1141.250000 | 0.0 | 0.0 | 0.0 | -1250.0 | 1669.0 | 313.000000 | -2335.0 | -2335.0 | -2335.0 | 0.00 | 0.00 | 444078.0 | 1.644289e+05 | 657715.500 | 70443.00 | 28081.125 | 112324.50 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 1085.0 | 1085.0 | 1085.0 | -35.0 | -35.0 | -35.0 | -1827.0 | -1044.0 | -1454.250000 | 0.000000 | 0.930700 | 0.375114 | -444078.0 | -3118.500 | -136347.7500 | 0.0 | 0.0 | 0.0 | 0.0 |

| 19 | 100025 | 1 | -700 | -700 | -700.000000 | 0 | 0 | 0.0 | 1124.0 | 1124.0 | 1124.000000 | NaN | NaN | NaN | NaN | NaN | 2452500.0 | 2.452500e+06 | 2452500.000 | 1886544.00 | 1.886544e+06 | 1886544.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1824.0 | -1824.0 | -1824.000000 | 0.769233 | 0.769233 | 0.769233 | -565956.00 | -565956.00 | -565956.000000 | 0.0 | 0 | 0.0 | 0 | 1.0 | -700.0 | -700.0 | -700.000000 | 0.0 | 0.0 | 0.0 | 1124.0 | 1124.0 | 1124.000000 | NaN | NaN | NaN | NaN | NaN | 2452500.0 | 2.452500e+06 | 2452500.000 | 1886544.00 | 1886544.000 | 1886544.00 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1824.0 | -1824.0 | -1824.000000 | 0.769233 | 0.769233 | 0.769233 | -565956.0 | -565956.000 | -565956.0000 | 0.0 | 0.0 | 0.0 | 0.0 |

bureau_agg.shape(305811, 93)SK_ID_CURR레벨로 건수 대비 연체 OVER 0, OVER 120 건수 비율 계산

select_columns = ['SK_ID_CURR', 'BUREAU_SK_ID_BUREAU_COUNT', 'BUREAU_BUREAU_IS_DPD_SUM', 'BUREAU_BUREAU_IS_DPD_OVER120_SUM',

'BUREAU_ACT_BUREAU_IS_DPD_SUM', 'BUREAU_ACT_BUREAU_IS_DPD_OVER120_SUM']

bureau_agg[select_columns].head(20) bureau_agg['BUREAU_BUREAU_IS_DPD_SUM'].value_counts()0 301947

1 3615

2 186

3 39

4 13

5 6

6 4

7 1

Name: BUREAU_BUREAU_IS_DPD_SUM, dtype: int64bureau_agg.columns.tolist()['SK_ID_CURR',

'BUREAU_SK_ID_BUREAU_COUNT',

'BUREAU_DAYS_CREDIT_MIN',

'BUREAU_DAYS_CREDIT_MAX',

'BUREAU_DAYS_CREDIT_MEAN',

'BUREAU_CREDIT_DAY_OVERDUE_MIN',

'BUREAU_CREDIT_DAY_OVERDUE_MAX',

'BUREAU_CREDIT_DAY_OVERDUE_MEAN',

'BUREAU_DAYS_CREDIT_ENDDATE_MIN',

'BUREAU_DAYS_CREDIT_ENDDATE_MAX',

'BUREAU_DAYS_CREDIT_ENDDATE_MEAN',

'BUREAU_DAYS_ENDDATE_FACT_MIN',

'BUREAU_DAYS_ENDDATE_FACT_MAX',

'BUREAU_DAYS_ENDDATE_FACT_MEAN',

'BUREAU_AMT_CREDIT_MAX_OVERDUE_MAX',

'BUREAU_AMT_CREDIT_MAX_OVERDUE_MEAN',

'BUREAU_AMT_CREDIT_SUM_MAX',

'BUREAU_AMT_CREDIT_SUM_MEAN',

'BUREAU_AMT_CREDIT_SUM_SUM',

'BUREAU_AMT_CREDIT_SUM_DEBT_MAX',

'BUREAU_AMT_CREDIT_SUM_DEBT_MEAN',

'BUREAU_AMT_CREDIT_SUM_DEBT_SUM',

'BUREAU_AMT_CREDIT_SUM_OVERDUE_MAX',

'BUREAU_AMT_CREDIT_SUM_OVERDUE_MEAN',

'BUREAU_AMT_CREDIT_SUM_OVERDUE_SUM',

'BUREAU_AMT_ANNUITY_MAX',

'BUREAU_AMT_ANNUITY_MEAN',

'BUREAU_AMT_ANNUITY_SUM',

'BUREAU_BUREAU_ENDDATE_FACT_DIFF_MIN',

'BUREAU_BUREAU_ENDDATE_FACT_DIFF_MAX',

'BUREAU_BUREAU_ENDDATE_FACT_DIFF_MEAN',

'BUREAU_BUREAU_CREDIT_FACT_DIFF_MIN',

'BUREAU_BUREAU_CREDIT_FACT_DIFF_MAX',

'BUREAU_BUREAU_CREDIT_FACT_DIFF_MEAN',

'BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MIN',

'BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MAX',

'BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MEAN',

'BUREAU_BUREAU_CREDIT_DEBT_RATIO_MIN',

'BUREAU_BUREAU_CREDIT_DEBT_RATIO_MAX',

'BUREAU_BUREAU_CREDIT_DEBT_RATIO_MEAN',

'BUREAU_BUREAU_CREDIT_DEBT_DIFF_MIN',

'BUREAU_BUREAU_CREDIT_DEBT_DIFF_MAX',

'BUREAU_BUREAU_CREDIT_DEBT_DIFF_MEAN',

'BUREAU_BUREAU_IS_DPD_MEAN',

'BUREAU_BUREAU_IS_DPD_SUM',

'BUREAU_BUREAU_IS_DPD_OVER120_MEAN',

'BUREAU_BUREAU_IS_DPD_OVER120_SUM',

'BUREAU_ACT_SK_ID_BUREAU_COUNT',

'BUREAU_ACT_DAYS_CREDIT_MIN',

'BUREAU_ACT_DAYS_CREDIT_MAX',

'BUREAU_ACT_DAYS_CREDIT_MEAN',

'BUREAU_ACT_CREDIT_DAY_OVERDUE_MIN',

'BUREAU_ACT_CREDIT_DAY_OVERDUE_MAX',

'BUREAU_ACT_CREDIT_DAY_OVERDUE_MEAN',

'BUREAU_ACT_DAYS_CREDIT_ENDDATE_MIN',

'BUREAU_ACT_DAYS_CREDIT_ENDDATE_MAX',

'BUREAU_ACT_DAYS_CREDIT_ENDDATE_MEAN',

'BUREAU_ACT_DAYS_ENDDATE_FACT_MIN',

'BUREAU_ACT_DAYS_ENDDATE_FACT_MAX',

'BUREAU_ACT_DAYS_ENDDATE_FACT_MEAN',

'BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MAX',

'BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MEAN',

'BUREAU_ACT_AMT_CREDIT_SUM_MAX',

'BUREAU_ACT_AMT_CREDIT_SUM_MEAN',

'BUREAU_ACT_AMT_CREDIT_SUM_SUM',

'BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MAX',

'BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MEAN',

'BUREAU_ACT_AMT_CREDIT_SUM_DEBT_SUM',

'BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MAX',

'BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MEAN',

'BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_SUM',

'BUREAU_ACT_AMT_ANNUITY_MAX',

'BUREAU_ACT_AMT_ANNUITY_MEAN',

'BUREAU_ACT_AMT_ANNUITY_SUM',

'BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MIN',

'BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MAX',

'BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MEAN',

'BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MIN',

'BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MAX',

'BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MEAN',

'BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MIN',

'BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MAX',

'BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MEAN',

'BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MIN',

'BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MAX',

'BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MEAN',

'BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MIN',

'BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MAX',

'BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MEAN',

'BUREAU_ACT_BUREAU_IS_DPD_MEAN',

'BUREAU_ACT_BUREAU_IS_DPD_SUM',

'BUREAU_ACT_BUREAU_IS_DPD_OVER120_MEAN',

'BUREAU_ACT_BUREAU_IS_DPD_OVER120_SUM']# SK_ID_CURR 레벨로 DPD 비율, DPD > 120 비율 확률, Active 상태에서 DPD 비율, DPD > 120 비율 확률

bureau_agg['BUREAU_IS_DPD_RATIO'] = bureau_agg['BUREAU_BUREAU_IS_DPD_SUM']/bureau_agg['BUREAU_SK_ID_BUREAU_COUNT']

bureau_agg['BUREAU_IS_DPD_OVER120_RATIO'] = bureau_agg['BUREAU_BUREAU_IS_DPD_OVER120_SUM']/bureau_agg['BUREAU_SK_ID_BUREAU_COUNT']

bureau_agg['BUREAU_ACT_IS_DPD_RATIO'] = bureau_agg['BUREAU_ACT_BUREAU_IS_DPD_SUM']/bureau_agg['BUREAU_SK_ID_BUREAU_COUNT']

bureau_agg['BUREAU_ACT_IS_DPD_OVER120_RATIO'] = bureau_agg['BUREAU_ACT_BUREAU_IS_DPD_OVER120_SUM']/bureau_agg['BUREAU_SK_ID_BUREAU_COUNT']bureau_agg.head(10)| SK_ID_CURR | BUREAU_SK_ID_BUREAU_COUNT | BUREAU_DAYS_CREDIT_MIN | BUREAU_DAYS_CREDIT_MAX | BUREAU_DAYS_CREDIT_MEAN | BUREAU_CREDIT_DAY_OVERDUE_MIN | BUREAU_CREDIT_DAY_OVERDUE_MAX | BUREAU_CREDIT_DAY_OVERDUE_MEAN | BUREAU_DAYS_CREDIT_ENDDATE_MIN | BUREAU_DAYS_CREDIT_ENDDATE_MAX | BUREAU_DAYS_CREDIT_ENDDATE_MEAN | BUREAU_DAYS_ENDDATE_FACT_MIN | BUREAU_DAYS_ENDDATE_FACT_MAX | BUREAU_DAYS_ENDDATE_FACT_MEAN | BUREAU_AMT_CREDIT_MAX_OVERDUE_MAX | BUREAU_AMT_CREDIT_MAX_OVERDUE_MEAN | BUREAU_AMT_CREDIT_SUM_MAX | BUREAU_AMT_CREDIT_SUM_MEAN | BUREAU_AMT_CREDIT_SUM_SUM | BUREAU_AMT_CREDIT_SUM_DEBT_MAX | BUREAU_AMT_CREDIT_SUM_DEBT_MEAN | BUREAU_AMT_CREDIT_SUM_DEBT_SUM | BUREAU_AMT_CREDIT_SUM_OVERDUE_MAX | BUREAU_AMT_CREDIT_SUM_OVERDUE_MEAN | BUREAU_AMT_CREDIT_SUM_OVERDUE_SUM | BUREAU_AMT_ANNUITY_MAX | BUREAU_AMT_ANNUITY_MEAN | BUREAU_AMT_ANNUITY_SUM | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MIN | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MAX | BUREAU_BUREAU_ENDDATE_FACT_DIFF_MEAN | BUREAU_BUREAU_CREDIT_FACT_DIFF_MIN | BUREAU_BUREAU_CREDIT_FACT_DIFF_MAX | BUREAU_BUREAU_CREDIT_FACT_DIFF_MEAN | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MIN | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MAX | BUREAU_BUREAU_CREDIT_ENDDATE_DIFF_MEAN | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MIN | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MAX | BUREAU_BUREAU_CREDIT_DEBT_RATIO_MEAN | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MIN | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MAX | BUREAU_BUREAU_CREDIT_DEBT_DIFF_MEAN | BUREAU_BUREAU_IS_DPD_MEAN | BUREAU_BUREAU_IS_DPD_SUM | BUREAU_BUREAU_IS_DPD_OVER120_MEAN | BUREAU_BUREAU_IS_DPD_OVER120_SUM | BUREAU_ACT_SK_ID_BUREAU_COUNT | BUREAU_ACT_DAYS_CREDIT_MIN | BUREAU_ACT_DAYS_CREDIT_MAX | BUREAU_ACT_DAYS_CREDIT_MEAN | BUREAU_ACT_CREDIT_DAY_OVERDUE_MIN | BUREAU_ACT_CREDIT_DAY_OVERDUE_MAX | BUREAU_ACT_CREDIT_DAY_OVERDUE_MEAN | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MIN | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MAX | BUREAU_ACT_DAYS_CREDIT_ENDDATE_MEAN | BUREAU_ACT_DAYS_ENDDATE_FACT_MIN | BUREAU_ACT_DAYS_ENDDATE_FACT_MAX | BUREAU_ACT_DAYS_ENDDATE_FACT_MEAN | BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MAX | BUREAU_ACT_AMT_CREDIT_MAX_OVERDUE_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_MAX | BUREAU_ACT_AMT_CREDIT_SUM_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_SUM | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MAX | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_DEBT_SUM | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MAX | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_MEAN | BUREAU_ACT_AMT_CREDIT_SUM_OVERDUE_SUM | BUREAU_ACT_AMT_ANNUITY_MAX | BUREAU_ACT_AMT_ANNUITY_MEAN | BUREAU_ACT_AMT_ANNUITY_SUM | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MIN | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MAX | BUREAU_ACT_BUREAU_ENDDATE_FACT_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_FACT_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_ENDDATE_DIFF_MEAN | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MIN | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MAX | BUREAU_ACT_BUREAU_CREDIT_DEBT_RATIO_MEAN | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MIN | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MAX | BUREAU_ACT_BUREAU_CREDIT_DEBT_DIFF_MEAN | BUREAU_ACT_BUREAU_IS_DPD_MEAN | BUREAU_ACT_BUREAU_IS_DPD_SUM | BUREAU_ACT_BUREAU_IS_DPD_OVER120_MEAN | BUREAU_ACT_BUREAU_IS_DPD_OVER120_SUM | BUREAU_IS_DPD_RATIO | BUREAU_IS_DPD_OVER120_RATIO | BUREAU_ACT_IS_DPD_RATIO | BUREAU_ACT_IS_DPD_OVER120_RATIO | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 7 | -1572 | -49 | -735.000000 | 0 | 0 | 0.0 | -1329.0 | 1778.0 | 82.428571 | -1328.0 | -544.0 | -825.500000 | NaN | NaN | 378000.0 | 207623.571429 | 1453365.000 | 373239.0 | 85240.928571 | 596686.5 | 0.0 | 0.0 | 0.0 | 10822.5 | 3545.357143 | 24817.5 | -1.0 | 698.0 | 197.000000 | -335.0 | -32.0 | -228.750000 | -1827.0 | -243.0 | -817.428571 | 0.0 | 0.987405 | 0.282518 | -279720.0 | -4761.0 | -122382.642857 | 0.0 | 0 | 0.0 | 0 | 3.0 | -559.0 | -49.0 | -309.333333 | 0.0 | 0.0 | 0.0 | 411.0 | 1778.0 | 1030.333333 | NaN | NaN | NaN | NaN | NaN | 378000.0 | 294675.0000 | 884025.000 | 373239.0 | 198895.500 | 596686.5 | 0.0 | 0.0 | 0.0 | 10822.5 | 8272.50 | 24817.5 | NaN | NaN | NaN | NaN | NaN | NaN | -1827.0 | -731.0 | -1339.666667 | 0.335128 | 0.987405 | 0.659208 | -224514.0 | -4761.000 | -95779.5000 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 1 | 100002 | 8 | -1437 | -103 | -874.000000 | 0 | 0 | 0.0 | -1072.0 | 780.0 | -349.000000 | -1185.0 | -36.0 | -697.500000 | 5043.645 | 1681.029 | 450000.0 | 108131.945625 | 865055.565 | 245781.0 | 49156.200000 | 245781.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.000000 | 0.0 | 0.0 | 1029.0 | 252.600000 | -609.0 | -76.0 | -277.000000 | -1822.0 | -87.0 | -719.833333 | 0.0 | 0.546180 | 0.136545 | -204219.0 | 0.0 | -98388.513000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -1042.0 | -103.0 | -572.500000 | 0.0 | 0.0 | 0.0 | 780.0 | 780.0 | 780.000000 | NaN | NaN | NaN | 40.5 | 40.5 | 450000.0 | 240994.2825 | 481988.565 | 245781.0 | 122890.500 | 245781.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.00 | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1822.0 | -1822.0 | -1822.000000 | 0.000000 | 0.546180 | 0.273090 | -204219.0 | -31988.565 | -118103.7825 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2 | 100003 | 4 | -2586 | -606 | -1400.750000 | 0 | 0 | 0.0 | -2434.0 | 1216.0 | -544.500000 | -2131.0 | -540.0 | -1097.333333 | 0.000 | 0.000 | 810000.0 | 254350.125000 | 1017400.500 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -303.0 | 201.0 | -34.000000 | -1096.0 | -154.0 | -568.333333 | -1822.0 | -152.0 | -856.250000 | 0.0 | 0.000000 | 0.000000 | -810000.0 | -22248.0 | -254350.125000 | 0.0 | 0 | 0.0 | 0 | 1.0 | -606.0 | -606.0 | -606.000000 | 0.0 | 0.0 | 0.0 | 1216.0 | 1216.0 | 1216.000000 | NaN | NaN | NaN | 0.0 | 0.0 | 810000.0 | 810000.0000 | 810000.000 | 0.0 | 0.000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1822.0 | -1822.0 | -1822.000000 | 0.000000 | 0.000000 | 0.000000 | -810000.0 | -810000.000 | -810000.0000 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 3 | 100004 | 2 | -1326 | -408 | -867.000000 | 0 | 0 | 0.0 | -595.0 | -382.0 | -488.500000 | -683.0 | -382.0 | -532.500000 | 0.000 | 0.000 | 94537.8 | 94518.900000 | 189037.800 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 88.0 | 44.000000 | -643.0 | -26.0 | -334.500000 | -731.0 | -26.0 | -378.500000 | 0.0 | 0.000000 | 0.000000 | -94537.8 | -94500.0 | -94518.900000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 0.0 | 0.0 | NaN | NaN |

| 4 | 100005 | 3 | -373 | -62 | -190.666667 | 0 | 0 | 0.0 | -128.0 | 1324.0 | 439.333333 | -123.0 | -123.0 | -123.000000 | 0.000 | 0.000 | 568800.0 | 219042.000000 | 657126.000 | 543087.0 | 189469.500000 | 568408.5 | 0.0 | 0.0 | 0.0 | 4261.5 | 1420.500000 | 4261.5 | -5.0 | -5.0 | -5.000000 | -250.0 | -250.0 | -250.000000 | -1461.0 | -184.0 | -630.000000 | 0.0 | 0.954794 | 0.601256 | -58500.0 | -4504.5 | -29572.500000 | 0.0 | 0 | 0.0 | 0 | 2.0 | -137.0 | -62.0 | -99.500000 | 0.0 | 0.0 | 0.0 | 122.0 | 1324.0 | 723.000000 | NaN | NaN | NaN | 0.0 | 0.0 | 568800.0 | 299313.0000 | 598626.000 | 543087.0 | 284204.250 | 568408.5 | 0.0 | 0.0 | 0.0 | 4261.5 | 2130.75 | 4261.5 | NaN | NaN | NaN | NaN | NaN | NaN | -1461.0 | -184.0 | -822.500000 | 0.848974 | 0.954794 | 0.901884 | -25713.0 | -4504.500 | -15108.7500 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 5 | 100007 | 1 | -1149 | -1149 | -1149.000000 | 0 | 0 | 0.0 | -783.0 | -783.0 | -783.000000 | -783.0 | -783.0 | -783.000000 | 0.000 | 0.000 | 146250.0 | 146250.000000 | 146250.000 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 0.0 | 0.0 | 0.000000 | -366.0 | -366.0 | -366.000000 | -366.0 | -366.0 | -366.000000 | 0.0 | 0.000000 | 0.000000 | -146250.0 | -146250.0 | -146250.000000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 0.0 | 0.0 | NaN | NaN |

| 6 | 100008 | 3 | -1097 | -78 | -757.333333 | 0 | 0 | 0.0 | -853.0 | 471.0 | -391.333333 | -1028.0 | -790.0 | -909.000000 | 0.000 | 0.000 | 267606.0 | 156148.500000 | 468445.500 | 240057.0 | 80019.000000 | 240057.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -2.0 | 175.0 | 86.500000 | -307.0 | -69.0 | -188.000000 | -549.0 | -244.0 | -366.000000 | 0.0 | 0.897054 | 0.299018 | -105705.0 | -27549.0 | -76129.500000 | 0.0 | 0 | 0.0 | 0 | 1.0 | -78.0 | -78.0 | -78.000000 | 0.0 | 0.0 | 0.0 | 471.0 | 471.0 | 471.000000 | NaN | NaN | NaN | 0.0 | 0.0 | 267606.0 | 267606.0000 | 267606.000 | 240057.0 | 240057.000 | 240057.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -549.0 | -549.0 | -549.000000 | 0.897054 | 0.897054 | 0.897054 | -27549.0 | -27549.000 | -27549.0000 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 7 | 100009 | 18 | -2882 | -239 | -1271.500000 | 0 | 0 | 0.0 | -2152.0 | 1402.0 | -794.937500 | -2152.0 | -313.0 | -1108.500000 | 0.000 | 0.000 | 1777500.0 | 266711.750000 | 4800811.500 | 557959.5 | 76953.535714 | 1077349.5 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -713.0 | 1459.0 | 114.785714 | -893.0 | -92.0 | -357.214286 | -1826.0 | -30.0 | -529.000000 | 0.0 | 0.967787 | 0.169369 | -1777500.0 | -10872.0 | -227088.000000 | 0.0 | 0 | 0.0 | 0 | 4.0 | -1293.0 | -239.0 | -591.750000 | 0.0 | 0.0 | 0.0 | -209.0 | 1402.0 | 596.500000 | NaN | NaN | NaN | NaN | NaN | 642861.0 | 381890.2500 | 1527561.000 | 557959.5 | 269337.375 | 1077349.5 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1826.0 | -30.0 | -928.000000 | 0.000000 | 0.967787 | 0.592792 | -187200.0 | -10872.000 | -112552.8750 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 8 | 100010 | 2 | -2741 | -1138 | -1939.500000 | 0 | 0 | 0.0 | -928.0 | 689.0 | -119.500000 | -1138.0 | -1138.0 | -1138.000000 | NaN | NaN | 675000.0 | 495000.000000 | 990000.000 | 348007.5 | 174003.750000 | 348007.5 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | 210.0 | 210.0 | 210.000000 | -1603.0 | -1603.0 | -1603.000000 | -1827.0 | -1813.0 | -1820.000000 | 0.0 | 0.515567 | 0.257783 | -326992.5 | -315000.0 | -320996.250000 | 0.0 | 0 | 0.0 | 0 | 1.0 | -1138.0 | -1138.0 | -1138.000000 | 0.0 | 0.0 | 0.0 | 689.0 | 689.0 | 689.000000 | NaN | NaN | NaN | NaN | NaN | 675000.0 | 675000.0000 | 675000.000 | 348007.5 | 348007.500 | 348007.5 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN | -1827.0 | -1827.0 | -1827.000000 | 0.515567 | 0.515567 | 0.515567 | -326992.5 | -326992.500 | -326992.5000 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 9 | 100011 | 4 | -2508 | -1309 | -1773.000000 | 0 | 0 | 0.0 | -2173.0 | -860.0 | -1293.250000 | -2197.0 | -968.0 | -1463.250000 | 10147.230 | 5073.615 | 145242.0 | 108807.075000 | 435228.300 | 0.0 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 | NaN | NaN | 0.0 | -102.0 | 758.0 | 170.000000 | -347.0 | -239.0 | -309.750000 | -1100.0 | -239.0 | -479.750000 | 0.0 | 0.000000 | 0.000000 | -145242.0 | -54000.0 | -96662.100000 | 0.0 | 0 | 0.0 | 0 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 0.0 | 0.0 | NaN | NaN |

bureau_bal의 주요 컬럼으로 aggregation 컬럼 생성.

bureau_bal을 SK_ID_CURR 별로 groupby 하기 위해 SK_ID_CURR을 가지고 있는 bureau와 조인

# 데이터 세트 재로딩.

apps, prev, bureau, bureau_bal = get_dataset()<ipython-input-2-eb2bde2565da>:4: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

apps = pd.concat([app_train, app_test])print(bureau_bal.shape, bureau.shape)

# bureau_bal과 bureau join

bureau_bal = bureau_bal.merge(bureau[['SK_ID_CURR', 'SK_ID_BUREAU']], on='SK_ID_BUREAU', how='left')

bureau_bal.shape(27299925, 3) (1716428, 17)

(27299925, 4)bureau_bal의 주요 컬럼으로 SK_ID_CURR레벨의 aggregation 컬럼 생성.

bureau_bal.head()| SK_ID_BUREAU | MONTHS_BALANCE | STATUS | SK_ID_CURR | |

|---|---|---|---|---|

| 0 | 5715448 | 0 | C | 380361.0 |

| 1 | 5715448 | -1 | C | 380361.0 |

| 2 | 5715448 | -2 | C | 380361.0 |

| 3 | 5715448 | -3 | C | 380361.0 |

| 4 | 5715448 | -4 | C | 380361.0 |

STATUS 컬럼에 따른 연체 OVER 0 , OVER 120 값 가공.

bureau_bal['STATUS'].value_counts()C 13646993

0 7499507

X 5810482

1 242347

5 62406

2 23419

3 8924

4 5847

Name: STATUS, dtype: int64bureau_bal['BUREAU_BAL_IS_DPD'] = bureau_bal['STATUS'].apply(lambda x: 1 if x in['1','2','3','4','5'] else 0)

bureau_bal['BUREAU_BAL_IS_DPD_OVER120'] = bureau_bal['STATUS'].apply(lambda x: 1 if x =='5' else 0)bureau_bal['BUREAU_BAL_IS_DPD'].value_counts()0 26956982

1 342943

Name: BUREAU_BAL_IS_DPD, dtype: int64bureau_bal_grp = bureau_bal.groupby('SK_ID_CURR')

# SK_ID_CURR 레벨로 건수와 MONTHS_BALANCE의 aggregation 가공

bureau_bal_agg_dict = {

'SK_ID_CURR':['count'],

'MONTHS_BALANCE':['min', 'max', 'mean'],

'BUREAU_BAL_IS_DPD':['mean', 'sum'],

'BUREAU_BAL_IS_DPD_OVER120':['mean', 'sum']

}

bureau_bal_agg = bureau_bal_grp.agg(bureau_bal_agg_dict)

# BUREAU_BAL을 접두어로 하는 새로운 컬럼명 할당.

bureau_bal_agg.columns = [ 'BUREAU_BAL_'+('_').join(column).upper() for column in bureau_bal_agg.columns.ravel() ]

# 조인을 위해 SK_ID_CURR을 reset_index()로 컬럼화

bureau_bal_agg = bureau_bal_agg.reset_index()

print(bureau_bal_agg.shape)

bureau_bal_agg.head()(134542, 9)| SK_ID_CURR | BUREAU_BAL_SK_ID_CURR_COUNT | BUREAU_BAL_MONTHS_BALANCE_MIN | BUREAU_BAL_MONTHS_BALANCE_MAX | BUREAU_BAL_MONTHS_BALANCE_MEAN | BUREAU_BAL_BUREAU_BAL_IS_DPD_MEAN | BUREAU_BAL_BUREAU_BAL_IS_DPD_SUM | BUREAU_BAL_BUREAU_BAL_IS_DPD_OVER120_MEAN | BUREAU_BAL_BUREAU_BAL_IS_DPD_OVER120_SUM | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001.0 | 172 | -51 | 0 | -16.279070 | 0.005814 | 1 | 0.0 | 0 |

| 1 | 100002.0 | 110 | -47 | 0 | -24.554545 | 0.245455 | 27 | 0.0 | 0 |

| 2 | 100005.0 | 21 | -12 | 0 | -4.333333 | 0.000000 | 0 | 0.0 | 0 |

| 3 | 100010.0 | 72 | -90 | -2 | -46.000000 | 0.000000 | 0 | 0.0 | 0 |

| 4 | 100013.0 | 230 | -68 | 0 | -29.373913 | 0.030435 | 7 | 0.0 | 0 |

bureau_bal_agg.columnsIndex(['SK_ID_CURR', 'BUREAU_BAL_SK_ID_CURR_COUNT',

'BUREAU_BAL_MONTHS_BALANCE_MIN', 'BUREAU_BAL_MONTHS_BALANCE_MAX',

'BUREAU_BAL_MONTHS_BALANCE_MEAN', 'BUREAU_BAL_BUREAU_BAL_IS_DPD_MEAN',

'BUREAU_BAL_BUREAU_BAL_IS_DPD_SUM',

'BUREAU_BAL_BUREAU_BAL_IS_DPD_OVER120_MEAN',

'BUREAU_BAL_BUREAU_BAL_IS_DPD_OVER120_SUM'],

dtype='object')SK_ID_CURR 레벨로 DPD 비율, DPD > 120 비율을 신규 컬럼 생성.

# SK_ID_CURR 레벨로 DPD 비율, DPD > 120 비율 가공

bureau_bal_agg['BUREAU_BAL_IS_DPD_RATIO'] = bureau_bal_agg['BUREAU_BAL_BUREAU_BAL_IS_DPD_SUM']/bureau_bal_agg['BUREAU_BAL_SK_ID_CURR_COUNT']

bureau_bal_agg['BUREAU_BAL_IS_DPD_OVER120_RATIO'] = bureau_bal_agg['BUREAU_BAL_BUREAU_BAL_IS_DPD_OVER120_SUM']/bureau_bal_agg['BUREAU_BAL_SK_ID_CURR_COUNT']bureau_agg, bureau_bal_agg 조인.

##### bureau_day_amt_agg, bureau_bal_agg 조인.

bureau_agg = bureau_day_amt_agg.merge(bureau_active_agg, on='SK_ID_CURR', how='left')

bureau_agg = bureau_agg.merge(bureau_bal_agg, on='SK_ID_CURR', how='left')print(bureau_agg.shape)(305811, 103)앞에서 처리한 데이터 가공 로직을 함수화

# bureau 채무 완료 날짜 및 대출 금액 대비 채무 금액 관련 컬럼 가공.

def get_bureau_processed(bureau):

# 예정 채무 시작 및 완료일과 실제 채무 완료일간의 차이 및 날짜 비율 가공.

bureau['BUREAU_ENDDATE_FACT_DIFF'] = bureau['DAYS_CREDIT_ENDDATE'] - bureau['DAYS_ENDDATE_FACT']

bureau['BUREAU_CREDIT_FACT_DIFF'] = bureau['DAYS_CREDIT'] - bureau['DAYS_ENDDATE_FACT']

bureau['BUREAU_CREDIT_ENDDATE_DIFF'] = bureau['DAYS_CREDIT'] - bureau['DAYS_CREDIT_ENDDATE']

# 채무 금액 대비/대출 금액 비율 및 차이 가공

bureau['BUREAU_CREDIT_DEBT_RATIO']=bureau['AMT_CREDIT_SUM_DEBT']/bureau['AMT_CREDIT_SUM']

#bureau['BUREAU_CREDIT_DEBT_DIFF'] = bureau['AMT_CREDIT_SUM'] - bureau['AMT_CREDIT_SUM_DEBT']

bureau['BUREAU_CREDIT_DEBT_DIFF'] = bureau['AMT_CREDIT_SUM_DEBT'] - bureau['AMT_CREDIT_SUM']

bureau['BUREAU_IS_DPD'] = bureau['CREDIT_DAY_OVERDUE'].apply(lambda x: 1 if x > 0 else 0)

bureau['BUREAU_IS_DPD_OVER120'] = bureau['CREDIT_DAY_OVERDUE'].apply(lambda x: 1 if x >120 else 0)

return bureau

# bureau 주요 컬럼 및 앞에서 채무 및 대출금액 관련 컬럼들로 SK_ID_CURR 레벨의 aggregation 컬럼 생성.

def get_bureau_day_amt_agg(bureau):

bureau_agg_dict = {

'SK_ID_BUREAU':['count'],

'DAYS_CREDIT':['min', 'max', 'mean'],

'CREDIT_DAY_OVERDUE':['min', 'max', 'mean'],

'DAYS_CREDIT_ENDDATE':['min', 'max', 'mean'],

'DAYS_ENDDATE_FACT':['min', 'max', 'mean'],

'AMT_CREDIT_MAX_OVERDUE': ['max', 'mean'],

'AMT_CREDIT_SUM': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_DEBT': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_OVERDUE': ['max', 'mean', 'sum'],

'AMT_ANNUITY': ['max', 'mean', 'sum'],

# 추가 가공 컬럼

'BUREAU_ENDDATE_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_ENDDATE_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_RATIO':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_DIFF':['min', 'max', 'mean'],

'BUREAU_IS_DPD':['mean', 'sum'],

'BUREAU_IS_DPD_OVER120':['mean', 'sum']

}

bureau_grp = bureau.groupby('SK_ID_CURR')

bureau_day_amt_agg = bureau_grp.agg(bureau_agg_dict)

bureau_day_amt_agg.columns = ['BUREAU_'+('_').join(column).upper() for column in bureau_day_amt_agg.columns.ravel()]

# 조인을 위해 SK_ID_CURR을 reset_index()로 컬럼화

bureau_day_amt_agg = bureau_day_amt_agg.reset_index()

print('bureau_day_amt_agg shape:', bureau_day_amt_agg.shape)

return bureau_day_amt_agg

# Bureau의 CREDIT_ACTIVE='Active' 인 데이터만 filtering 후 주요 컬럼 및 앞에서 채무 및 대출금액 관련 컬럼들로 SK_ID_CURR 레벨의 aggregation 컬럼 생성

def get_bureau_active_agg(bureau):

# CREDIT_ACTIVE='Active' 인 데이터만 filtering

cond_active = bureau['CREDIT_ACTIVE'] == 'Active'

bureau_active_grp = bureau[cond_active].groupby(['SK_ID_CURR'])

bureau_agg_dict = {

'SK_ID_BUREAU':['count'],

'DAYS_CREDIT':['min', 'max', 'mean'],

'CREDIT_DAY_OVERDUE':['min', 'max', 'mean'],

'DAYS_CREDIT_ENDDATE':['min', 'max', 'mean'],

'DAYS_ENDDATE_FACT':['min', 'max', 'mean'],

'AMT_CREDIT_MAX_OVERDUE': ['max', 'mean'],

'AMT_CREDIT_SUM': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_DEBT': ['max', 'mean', 'sum'],

'AMT_CREDIT_SUM_OVERDUE': ['max', 'mean', 'sum'],

'AMT_ANNUITY': ['max', 'mean', 'sum'],

# 추가 가공 컬럼

'BUREAU_ENDDATE_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_FACT_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_ENDDATE_DIFF':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_RATIO':['min', 'max', 'mean'],

'BUREAU_CREDIT_DEBT_DIFF':['min', 'max', 'mean'],

'BUREAU_IS_DPD':['mean', 'sum'],

'BUREAU_IS_DPD_OVER120':['mean', 'sum']

}

bureau_active_agg = bureau_active_grp.agg(bureau_agg_dict)

bureau_active_agg.columns = ['BUREAU_ACT_'+('_').join(column).upper() for column in bureau_active_agg.columns.ravel()]

# 조인을 위해 SK_ID_CURR을 reset_index()로 컬럼화

bureau_active_agg = bureau_active_agg.reset_index()

print('bureau_active_agg shape:', bureau_active_agg.shape)

return bureau_active_agg

# bureau_bal을 SK_ID_CURR 레벨로 건수와 MONTHS_BALANCE의 aggregation 가공

def get_bureau_bal_agg(bureau, bureau_bal):

bureau_bal = bureau_bal.merge(bureau[['SK_ID_CURR', 'SK_ID_BUREAU']], on='SK_ID_BUREAU', how='left')

bureau_bal['BUREAU_BAL_IS_DPD'] = bureau_bal['STATUS'].apply(lambda x: 1 if x in['1','2','3','4','5'] else 0)

bureau_bal['BUREAU_BAL_IS_DPD_OVER120'] = bureau_bal['STATUS'].apply(lambda x: 1 if x =='5' else 0)

bureau_bal_grp = bureau_bal.groupby('SK_ID_CURR')

# SK_ID_CURR 레벨로 건수와 MONTHS_BALANCE의 aggregation 가공

bureau_bal_agg_dict = {

'SK_ID_CURR':['count'],

'MONTHS_BALANCE':['min', 'max', 'mean'],

'BUREAU_BAL_IS_DPD':['mean', 'sum'],

'BUREAU_BAL_IS_DPD_OVER120':['mean', 'sum']

}

bureau_bal_agg = bureau_bal_grp.agg(bureau_bal_agg_dict)

bureau_bal_agg.columns = [ 'BUREAU_BAL_'+('_').join(column).upper() for column in bureau_bal_agg.columns.ravel() ]

# 조인을 위해 SK_ID_CURR을 reset_index()로 컬럼화

bureau_bal_agg = bureau_bal_agg.reset_index()

print('bureau_bal_agg shape:', bureau_bal_agg.shape)

return bureau_bal_agg

# 가공된 bureau관련 aggregation 컬럼들을 모두 결합

def get_bureau_agg(bureau, bureau_bal):

bureau = get_bureau_processed(bureau)

bureau_day_amt_agg = get_bureau_day_amt_agg(bureau)

bureau_active_agg = get_bureau_active_agg(bureau)

bureau_bal_agg = get_bureau_bal_agg(bureau, bureau_bal)

# 가공된 bureau관련 aggregation 컬럼들을 모두 조인하여 결합 후 return

bureau_agg = bureau_day_amt_agg.merge(bureau_active_agg, on='SK_ID_CURR', how='left')

bureau_agg = bureau_agg.merge(bureau_bal_agg, on='SK_ID_CURR', how='left')

print('bureau_agg shape:', bureau_agg.shape)

return bureau_agg기존 application 및 previous 데이터 가공 로직 복사

from sklearn.model_selection import train_test_split

from lightgbm import LGBMClassifier

def get_apps_processed(apps):

# EXT_SOURCE_X FEATURE 가공

apps['APPS_EXT_SOURCE_MEAN'] = apps[['EXT_SOURCE_1', 'EXT_SOURCE_2', 'EXT_SOURCE_3']].mean(axis=1)

apps['APPS_EXT_SOURCE_STD'] = apps[['EXT_SOURCE_1', 'EXT_SOURCE_2', 'EXT_SOURCE_3']].std(axis=1)

apps['APPS_EXT_SOURCE_STD'] = apps['APPS_EXT_SOURCE_STD'].fillna(apps['APPS_EXT_SOURCE_STD'].mean())

# AMT_CREDIT 비율로 Feature 가공

apps['APPS_ANNUITY_CREDIT_RATIO'] = apps['AMT_ANNUITY']/apps['AMT_CREDIT']

apps['APPS_GOODS_CREDIT_RATIO'] = apps['AMT_GOODS_PRICE']/apps['AMT_CREDIT']

# AMT_INCOME_TOTAL 비율로 Feature 가공

apps['APPS_ANNUITY_INCOME_RATIO'] = apps['AMT_ANNUITY']/apps['AMT_INCOME_TOTAL']

apps['APPS_CREDIT_INCOME_RATIO'] = apps['AMT_CREDIT']/apps['AMT_INCOME_TOTAL']

apps['APPS_GOODS_INCOME_RATIO'] = apps['AMT_GOODS_PRICE']/apps['AMT_INCOME_TOTAL']

apps['APPS_CNT_FAM_INCOME_RATIO'] = apps['AMT_INCOME_TOTAL']/apps['CNT_FAM_MEMBERS']

# DAYS_BIRTH, DAYS_EMPLOYED 비율로 Feature 가공

apps['APPS_EMPLOYED_BIRTH_RATIO'] = apps['DAYS_EMPLOYED']/apps['DAYS_BIRTH']

apps['APPS_INCOME_EMPLOYED_RATIO'] = apps['AMT_INCOME_TOTAL']/apps['DAYS_EMPLOYED']

apps['APPS_INCOME_BIRTH_RATIO'] = apps['AMT_INCOME_TOTAL']/apps['DAYS_BIRTH']

apps['APPS_CAR_BIRTH_RATIO'] = apps['OWN_CAR_AGE'] / apps['DAYS_BIRTH']

apps['APPS_CAR_EMPLOYED_RATIO'] = apps['OWN_CAR_AGE'] / apps['DAYS_EMPLOYED']

return apps

def get_prev_processed(prev):

# 대출 신청 금액과 실제 대출액/대출 상품금액 차이 및 비율

prev['PREV_CREDIT_DIFF'] = prev['AMT_APPLICATION'] - prev['AMT_CREDIT']

prev['PREV_GOODS_DIFF'] = prev['AMT_APPLICATION'] - prev['AMT_GOODS_PRICE']